A single vendor outage can disrupt trading, delay transactions, and block customers from accessing critical services even when internal systems are healthy.

Gado via Getty Images

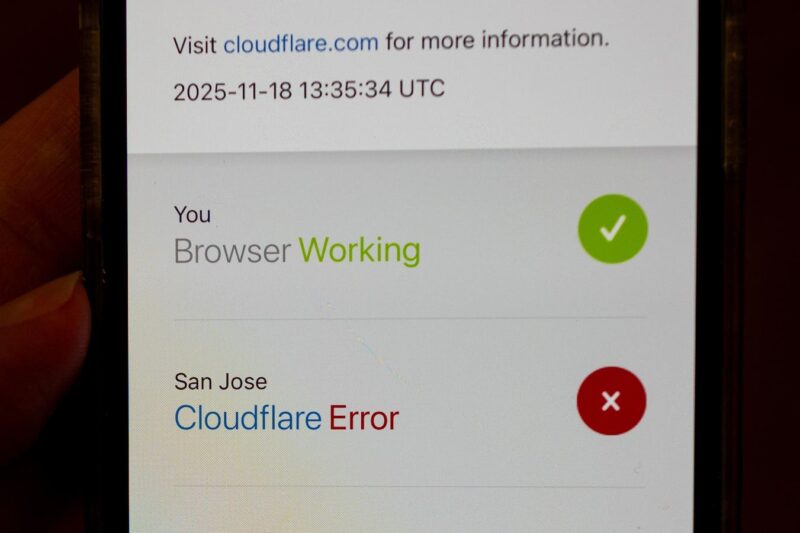

The digital world relies on a relatively small number of critical infrastructure providers to ensure speed, security, and uptime. When one of these players, like Cloudflare, experiences an outage, the ripple effects can be felt across the entire internet, including the highly sensitive financial services industry.

Cloudflare, a content delivery network (CDN) and security provider, acts as an intermediary, shielding websites from malicious attacks. However, its global reach means that when its network falters, a significant portion of the internet can become inaccessible or heavily degraded.

For financial services firms, the incident was more than an inconvenience. It exposed how much of Wall Street now relies on a single point of internet access.

For more like this on Forbes, AWS Outage: Billions Lost, Multi-Cloud Is Wall Street’s Solution.

Firms Affected Across the Sector

Reporting from industry outlets and mainstream media confirms the impact across multiple segments of the market.

Crypto exchanges and blockchain services

Coinbase faced service interruptions across its trading platform and its Base network. Other crypto firms, including Kraken, Aave, Etherscan, and additional defi platforms, also saw outages or performance degradation. These platforms depend on Cloudflare for traffic management and DDoS protection, so any disruption in Cloudflare’s network quickly affects user access.

Retail brokers and trading apps

Several online brokers, including Monaxa, Skilling, Xtrade, and FXPro, reported downtime tied directly to the Cloudflare incident. Although their core trading engines continued running, customers could not access the front end due to this disruption.

Credit rating and financial data firms

Moody’s public website displayed Cloudflare error notifications, confirming that its public-facing services rely on Cloudflare’s CDN layer. While internal rating systems likely remained operational, public access was down.

More from Forbes: How And Why FICO’s New License Disrupts The Credit Bureaus.

How Financial Firms Should Reduce Exposure

This type of outage cannot be prevented by those paying for the service. What financial firms can control is how much of their customer experience depends on a single vendor. Investors and regulators increasingly expect the sector to show resiliency when external infrastructure fails. Here are the steps firms should take now.

Identify and map the Cloudflare dependency

Many institutions do not know which business units rely on Cloudflare for DNS, firewall functions, or CDN traffic. A full inventory is the first step. If a firm cannot produce this information quickly, it already faces unnecessary operational risk.

Add multi CDN or direct to origin failover options

Cloudflare can remain the primary provider, but alternative paths must exist and be tested. These may include a second CDN provider, a direct access route to the origin servers, or a simplified fallback site that bypasses complex edge features.

Separate critical customer flows from marketing systems

Trading, payments, onboarding, and account access should not rely on the same edge configuration as non essential websites. Firms with a single edge layer for all properties risk losing everything at once.

Build graceful degradation paths

If the CDN layer fails, customers should still be able to complete key tasks. This can be done through mobile app routes, lite browser clients, or backup domains that use alternate networking paths.

Conduct real outage simulations

Playbooks are not enough. Firms need to simulate vendor failures in live exercises, measure how long it takes to reroute traffic, and refine their response process.

Strengthen vendor contracts

If Cloudflare is mission critical, firms should require clear recovery time objectives, transparency on operational dependencies, and the ability to conduct joint resiliency testing.

The Strategic Lesson

Financial services companies built this vulnerability by centralizing customer access through a single internet gateway. The Cloudflare outage did not create the risk. It revealed it.

The firms that rework their architectures now will see the next outage as a manageable incident rather than a public failure. Those that do not will continue to outsource their resilience to a third party that cannot guarantee perpetual availability.

In a sector where trust and uptime define the brand, that is a risk no financial institution can afford to ignore.

Follow Holloman for more insights on the future of finance and technology.