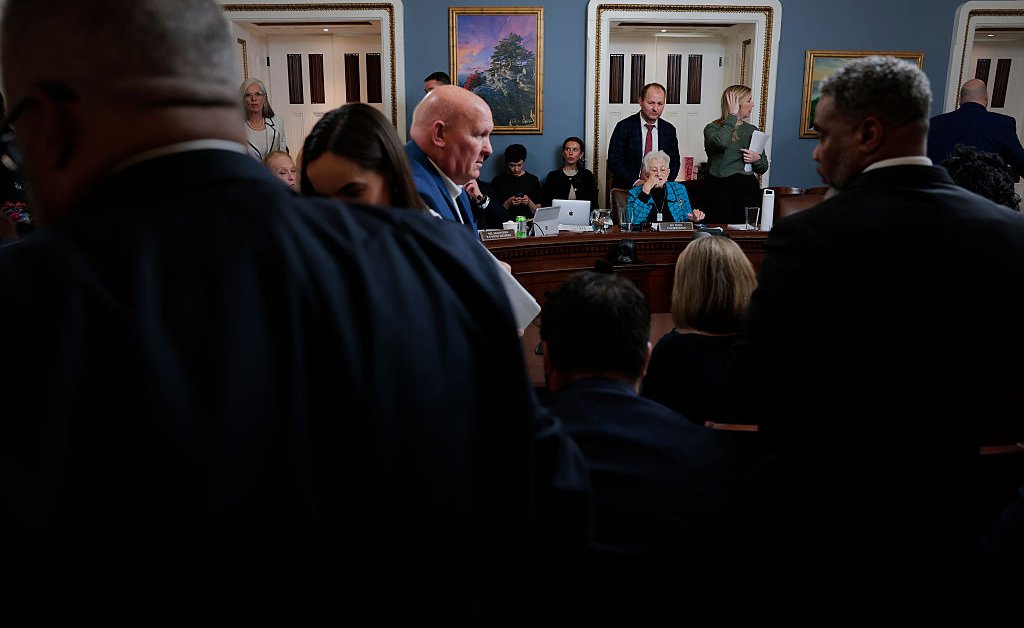

A key House committee voted to advance President Donald Trump’s sweeping tax and spending bill late Wednesday evening, clearing a major hurdle after days of internal Republican infighting and setting the stage for a floor vote in the full House early Thursday.

The breakthrough came after frenzied, late-night negotiations that yielded just enough concessions to bring key GOP holdouts on the House Rules Committee back on board, despite deep divisions over the bill’s cost and proposed changes to Medicaid. In the end, all but one Republican voted the bill out of committee—Rep. Chip Roy of Texas, who skipped the vote—ending the committee’s debate that began more than 22 hours ago.

“I’m convinced we’re going to pass this bill tonight,” House Speaker Mike Johnson told reporters after the committee vote, signaling that he plans to bring it to the floor overnight. “I may have one or two nos, you never can be certain,” he said, but added: “I think we’re going to get this job done and we’re going to do it by Memorial Day, which is what we projected from the beginning.”

Clearing the Rules Committee marks a major win for Trump, who has been lobbying aggressively for the Congress to pass his “One Big, Beautiful Bill” to cement a host of conservative priorities central to his second-term agenda. Trump had grown increasingly impatient with Republican holdouts, labeling some of them as “grandstanders” who should leave the party.

The White House and Republican leaders ultimately decided to revise the bill late Wednesday to address concerns from members of the House Freedom Caucus, who were demanding faster, larger spending cuts and energy tax-credit phaseouts. Trump had invited Speaker Johnson and key holdouts to meet at the White House to bridge their differences. Several of those holdouts emerged from that meeting saying it helped them get on the same page as Trump.

A review of the amendments shows that the revised bill would accelerate new Medicaid work requirements to December 2026; end many tax credits for wind energy, solar energy, and battery storage by 2028; nix a tax on gun silencers; formally lock in a $40,000 cap on the state and local tax (SALT) deduction; and provide $12 billion in funding to reimburse states for assisting with border security since January 2021.

The bill now heads for a vote in the full House, where Speaker Johnson is operating under very tight margins: House Republicans have one of the thinnest majorities in history at 220-212, meaning Johnson can only afford to lose three members of his caucus if all Democrats are opposed.

Trump and congressional leaders have set July 4 as the deadline for final approval of the legislation, with the Speaker insisting the House must pass the bill before Memorial Day, which is Monday. Some of the holdouts had taken issue with the timeline, saying they won’t be rushed into a deal without concessions.

Trump’s legislation, at more than 1,100 pages, would permanently extend his 2017 tax cuts set to expire at the end of this year while introducing new policies like tax exemptions for tips and overtime wages. It also boosts spending on defense and border security, while reducing spending on Medicaid and food stamps. The measure would also roll back green energy tax credits from the Biden Administration, including the $7,500 electric vehicle tax credit incentive.

Nonpartisan research groups studying the proposal have estimated that it would add more than $2.5 trillion to the federal debt over the next ten years. A senior White House official refuted those projections to TIME, claiming that the legislation would actually reduce the nation’s debt by generating an additional $2.6 trillion in revenue over the next ten years through increased economic growth.

Some hardline conservatives were previously not convinced the legislation cuts spending enough, complaining that the bill should halt clean-energy tax breaks sooner than proposed, and that new work requirements for some Medicaid recipients should start earlier than 2029.

Democrats have warned that the measure would force millions of low-income Americans off Medicaid and food assistance programs, to fund tax cuts for the wealthy. “The structure of this bill is such that low- and middle-income households bear the brunt, while the wealthy reap significant benefits,” says Daniel Hornung, the former Deputy Director of the National Economic Council under President Joe Biden.

An analysis from the nonpartisan Congressional Budget Office (CBO) released Tuesday shows that the wealthiest households are expected to gain from the bill, while the lowest-income households would lose out on resources because of the spending cuts. A separate CBO report estimated that the proposed changes to Medicaid could leave 7.6 million Americans without insurance.

“President Trump promised to lower the high cost of living in America. He has failed,” House Minority Leader Hakeem Jeffries said in a statement on Wednesday. “Costs aren’t going down, they are going up. The GOP Tax Scam will make life more expensive for everyday Americans and it’s his toxic legislation that represents the ultimate betrayal.”