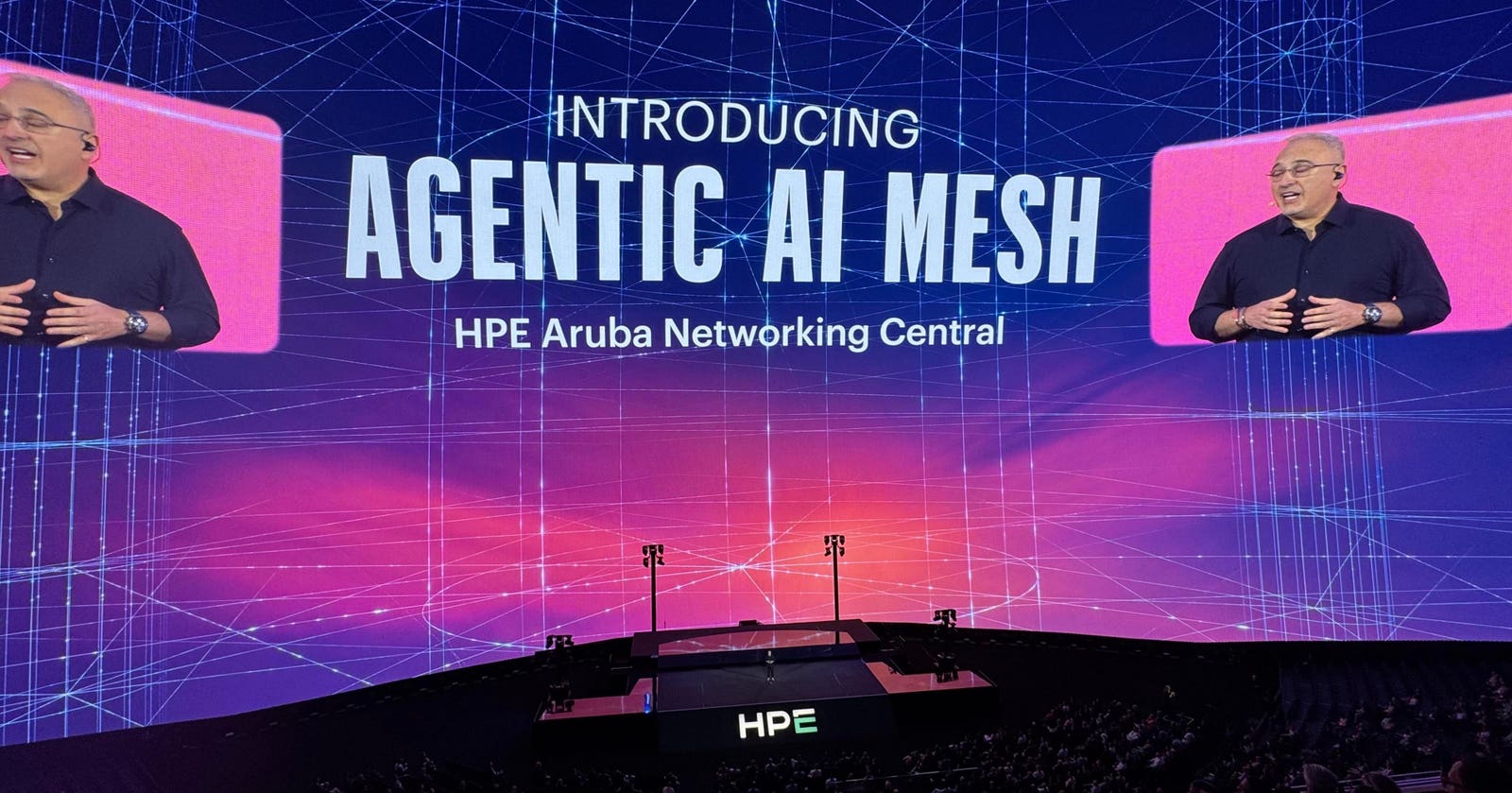

CEO Antonio Neri delivers the keynote at HPE Discover 2025 at The Sphere in Las Vegas.

Hewlett Packard Enterprise celebrates its tenth anniversary this year, and the company’s recent Discover annual user and partner conference in Las Vegas served as a showcase for its past decade of accomplishments, as well as the ten-year anniversary of its acquisition of Aruba in 2015. The event also served as the debut for HPE’s new brand mark, refreshing a stodgy and text-heavy logo by incorporating a variation on Hewlett Packard’s iconic green badge that is meant to appear open to the future.

HPE’S new corporate logo

HPE’s future is decidedly agentic in its focus, as evidenced by Discover’s overall theme and the race for the company and other IT infrastructure providers to capitalize on the already lucrative and potentially transformative opportunity in enabling modern AI for enterprises at scale. A handful of the company’s AI-infused announcements at the event were especially noteworthy. And while I like what HPE is doing, I believe that it can improve upon some of its efforts to further its AI-for-networking and networking-for-AI ambitions. With that context set, let’s dive in.

(Note: HPE is an advisory client of my firm, Moor Insights & Strategy.)

The Promise Of HPE Aruba Networking’s Agentic AI Mesh

Enterprises are faced with daunting networking challenges today, as outlined by Aruba’s chief product officer David Hughes in his technical keynote on day three of the conference. Hughes pointed to the simultaneous needs to support demanding users who expect zero downtime, to enable IT teams to do more with less, to protect organizations from escalating cyber threats, to mitigate ongoing geopolitical risks that threaten business continuity and data protection, and to ease management tied to multi-vendor and multi-domain operations.

The company aims to address these needs with its new Agentic AI Mesh offering from HPE Aruba Networking. At preview, it includes a pool of fifteen purpose-built agents and an orchestration super-agent, complemented by a networking copilot. The networking agentic AI functionality integrated into HPE Aruba Networking’s Central control console is designed to broadly automate network functionality. Over time, this should facilitate easier root cause analysis, help remediate issues quickly and ultimately deliver a self-healing capability.

On the surface, Agentic AI Mesh offers a robust set of capabilities that can address enterprises’ networking and security challenges, building upon the company’s historic leadership in AIOps and anchored by its Edge Services Platform launched five years ago. I believe that when HPE Aruba Networking’s agentic AI framework becomes generally available in the third calendar quarter of this year, it will have the potential to scale automation, bolster network assurance and improve security outcomes. At the conference, I also had the opportunity to speak with Hughes in a Six Five in the Booth fireside chat, during which he highlighted what the company believes it can accomplish with the new offering.

GreenLake Intelligence: A Cross-Portfolio Vison For Automation At Scale

Aruba’s Agentic AI Mesh is part of a broader HPE vision — called GreenLake Intelligence — to bring the power of agentic AI to its entire infrastructure stack within its hybrid cloud services portfolio. From my perspective, HPE has been a trailblazer in offering its complete set of networking, security, compute and storage solutions as consumptive services. The benefits to enterprises include highly flexible — and fast — deployment, the ability to treat infrastructure as an operational expense to reap balance-sheet benefits and a continuous delivery mechanism to bring organizations the latest features and capabilities on a steady cadence.

HPE believes that its GreenLake Intelligence agentic AI framework has the potential to solve siloed and manual workflows, enable troubleshooting issues across its entire infrastructure expanse (including multi-vendor equipment) through its OpsRamp observability platform, identify underutilized resources and reduce operational burdens. It is a bold vision — one whose success will lie in flawless execution across a broad and deep set of IT and OT solution offerings.

Deeper Portfolio And AI Ecosystem Capabilities Announced At HPE Discover

In addition to HPE Aruba Networking’s Agentic AI Mesh and the GreenLake Intelligence framework, the company made three other noteworthy announcements. First, HPE is deepening its network and data observability capabilities with further integrations of its OpsRamp acquisition from two years ago. The company aims to leverage OpsRamp to enable new conversational assistance to manage fault detection, capacity planning and more through an agentic command center.

I like OpsRamp’s ability to provide visibility across multi-vendor infrastructure, as well as the promise of improved network assurance and security posture through a single pane of glass. The effort also allows HPE to better compete with Cisco’s more mature full-stack observability platform, which leverages both Cisco’s organic roadmap efforts and its acquisitions of ThousandEyes, AppDynamics, Accedian and other observability and monitoring solutions.

Second, HPE Aruba Networking announced a private 5G competency program to accelerate the adoption of its cellular connectivity offering. The program is designed to provide channel partners with expertise in developing and deploying solutions that streamline private cellular deployments in what I judge to be OT environments. It also positions the company to support deterministic use-case needs such as manufacturing automation, logistics and, more broadly, cost-effective connectivity solutions for indoor and outdoor deployments.

HPE has shifted its focus on serving the broader telecom mobile network operators to enabling private LTE and 5G enterprise networks since its acquisition of cellular core provider Athonet two years ago. This has been a smart move for the company, given the growing adoption of private networks and the obvious sales adjacencies for HPE to extend its reach beyond Wi-Fi and wired deployments. From my perspective, it also represents deeper margin opportunities for the company relative to the poorer economics tied to public cellular deployments. I also like HPE’s full-stack offering, which includes HPE core and radio access network infrastructure, as well as its strengths in orchestration software rooted in its prior carrier-grade development efforts.

Third, HPE announced an extension of its Unleash AI ecosystem that adds more than two dozen new partners and identifies over seventy-five new use cases designed to accelerate enterprise adoption of modern AI applications and workloads. AI ecosystem efforts by the likes of Nvidia are making it easier for organizations to accelerate time-to-value with generative and agentic AI features, and HPE’s focus here could pay big dividends with the adoption of its complete AI infrastructure stack.

At HPE Discover, I also sat down with the Six Five Live team to share my hot takes on HPE’s announcements, providing further insights on the company’s AI ambitions.

HPE’s Opportunities For Improvement

From my perspective, there is a lot to like about the announcements at HPE Discover. However, details about what customers will be expected to pay for new functionality such as the Agentic AI Mesh were vague. To be fair, this may be because the offering is only in preview now; even so, setting an expectation for licensing costs could have strengthened its appeal.

Additionally, HPE partner sales enablement could be a tricky endeavor — especially when we consider that Cisco’s AI Canvas and Deep Network LLM, announced just a few weeks ago, compete with HPE Aruba Networking’s latest offering. I would have liked to see more details related to HPE’s channel education efforts, highlighting what is unique to its approach for sellers beyond the perceived strengths that Hughes communicated in his technical keynote.

Is It Time To Call A Winner?

It is tough to call an immediate winner in this competition, given the newness of both Cisco’s and HPE’s agentic AI offerings for networking. However, the late-breaking news, on the heels of Discover, that HPE is successfully closing its contested acquisition of Juniper Networks and avoiding an antitrust trial in July ends the unnecessary distractions. It also paves the way for a strengthened HPE Aruba Networking portfolio thanks to the depth provided by Juniper’s Mist AI software; this is true despite the DOJ’s requirement that HPE divest its Instant On small business products and license the source code for Mist AI. On that last point, I highly doubt that other enterprise networking infrastructure providers will pay to license the software, considering how far HPE’s competitors are along their own AI development paths. However, a handful of smaller consumer Wi-Fi solution providers may take advantage of the licensing opportunity.

From the day that HPE and Juniper announced their deal, I have held the position that the tie-up will do more to foster competition and innovation than thwart it. Ultimately, customers will win by having a stronger second choice for AI-enabled network infrastructure after Cisco.

Tenth anniversaries are often symbolized by tin or aluminum — connoting strength and flexibility. HPE Discover 2025 went far to demonstrate the company’s strengths in networking, cross-portfolio automation and observability as it addresses the complex challenges that organizations face today. The event also clearly demonstrated HPE’s flexibility through broad industry collaboration, evidenced by the company’s growing partnership with Nvidia and HPE’s Unleash AI ecosystem. Both have the potential to accelerate enterprise adoption of modern AI applications and the management of AI workloads at scale with highly performant networking infrastructure and consumptive hybrid cloud services.

HPE’s success will depend on its ability to execute against its agentic AI vision, quickly leverage and integrate Juniper’s intellectual property and convince its channel partners to lead with its solutions. The bedrock to accomplish all of these is firmly laid, and it will be interesting to watch what the company can unlock in terms of both technical innovation and effective sales execution.

Moor Insights & Strategy provides or has provided paid services to technology companies, like all tech industry research and analyst firms. These services include research, analysis, advising, consulting, benchmarking, acquisition matchmaking and video and speaking sponsorships. Of the companies mentioned in this article, Moor Insights & Strategy currently has (or has had) a paid business relationship with Cisco, HPE and Nvidia.