What to do if you get a suspicious bank text claiming to be from Chase

NEWYou can now listen to Fox News articles!

If you get a text claiming to be from your bank, especially one asking you to act fast, it might be a scam.

Chase customers are among the latest targets in a phishing campaign using fake alerts to trick people into giving up account information.

Bill from Idaho, recently emailed us to share his experience after receiving a convincing scam text that almost fooled him. Here’s what happened and what you can do to protect yourself.

SOCIAL SECURITY ADMINISTRATION PHISHING SCAM TARGETS RETIREES

A man receives a bank text scam on his phone. (Kurt “CyberGuy” Knutsson)

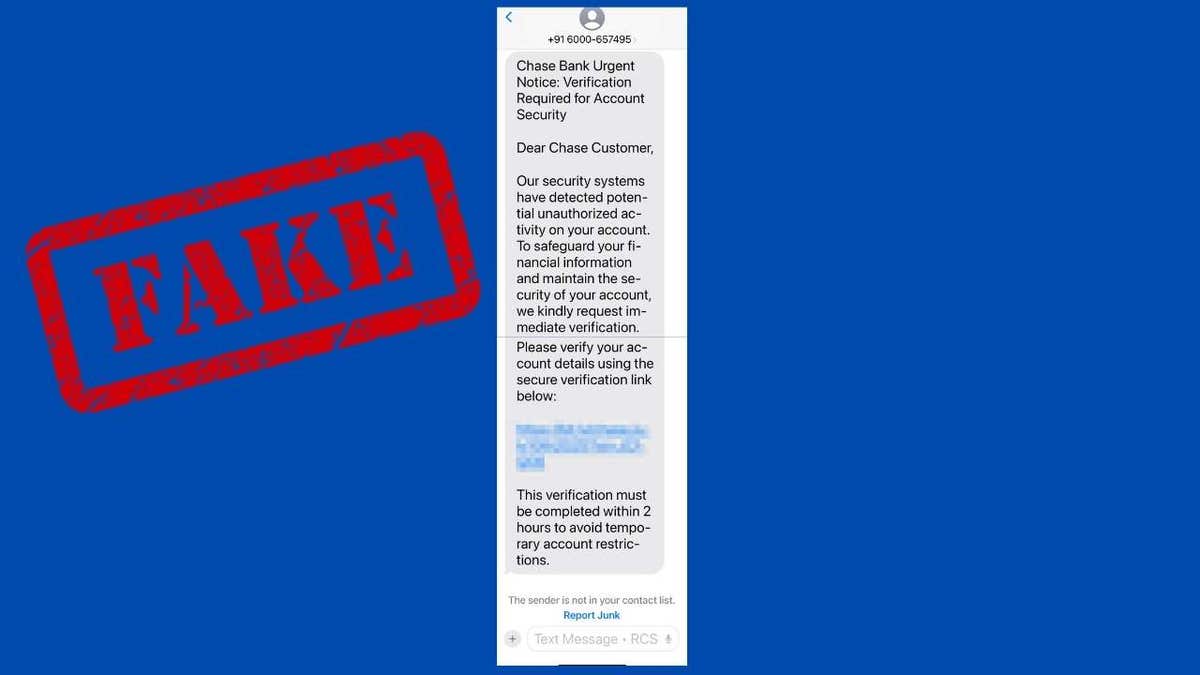

The Chase scam text that looked real

Bill got a message on his iPhone that looked like it came from Chase. Here’s what it said:

Chase Bank Urgent Notice: Verification Required for Account Security

Dear Chase Customer,

Our security systems have detected potential unauthorized activity on your account. To safeguard your financial information and maintain the security of your account, we kindly request immediate verification. Please verify your account details using the secure verification link below:

This verification must be completed within two hours to avoid temporary account restrictions.

“I didn’t click the link, thankfully,” Bill told us. “But since I’m a Chase customer, it made me pause.” He reached out to the bank directly and was told the message was a scam.

An actual Chase Bank text scam received on an iPhone. (Kurt “CyberGuy” Knutsson)

How to spot a bank scam text

Scammers are getting better at writing messages that look official, but there are still signs you can watch for.

1. The message creates urgency

Phishing texts often say you have a limited time to act. This tactic is designed to make you panic and click without thinking.

2. The link looks suspicious

A real Chase message wouldn’t use a shortened URL like bit.ly. Always inspect links closely, but never click on them if you’re unsure.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

3. The tone or wording seems off

Scam messages may look polished, but often include awkward phrases or formatting.

4. It asks for account verification

Banks don’t ask for personal information or login details by text. If they need you to take action, they’ll direct you to log in securely through their app or website.

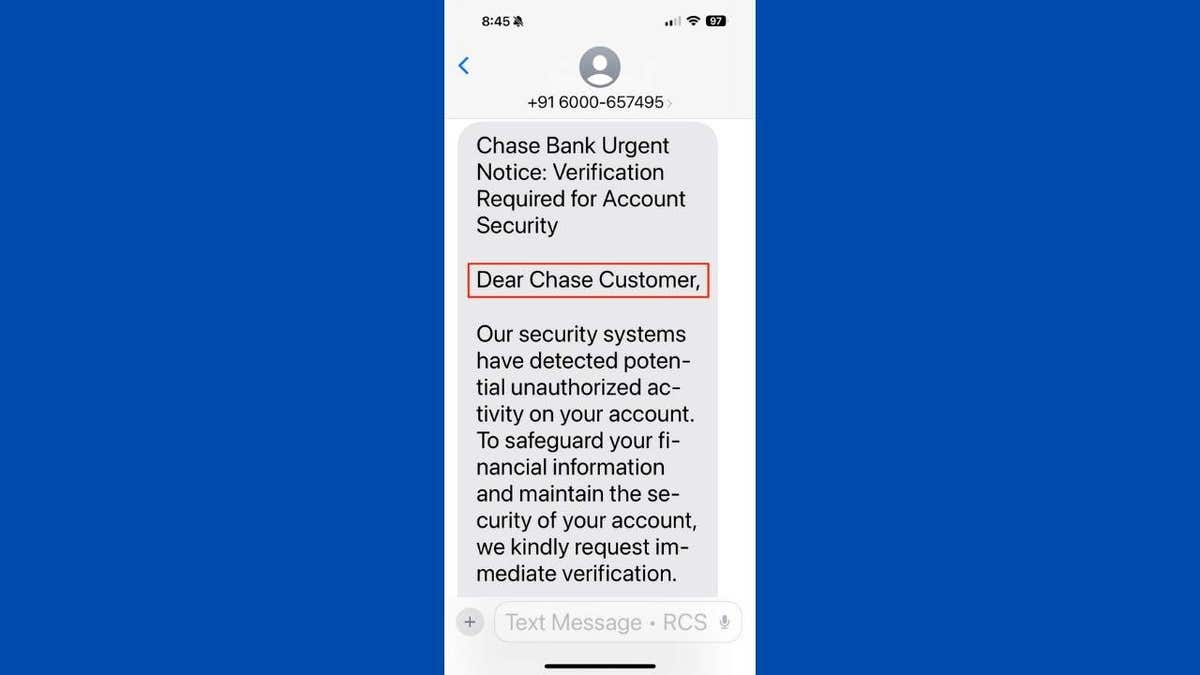

5. The greeting is generic

If a message says “Dear customer” instead of using your name, that’s a red flag.

An actual Chase Bank text scam received on an iPhone. (Kurt “CyberGuy” Knutsson)

What to do if you receive a bank scam text

If you ever get a text like this, follow these steps:

- Don’t click any links in the message.

- Do not reply or engage with the sender.

- Take a screenshot in case you want to report it.

- Contact Chase directly through their app or the number on your card.

- Report the message by forwarding it to 7726 (SPAM) and emailing [email protected].

- File a report with the FTC at reportfraud.ftc.gov if you think your information was compromised.

Tips to protect yourself from bank scam texts

You can take a few proactive steps to reduce your risk of falling for a Chase scam text-or any phishing attempt. These strategies can help you stay one step ahead.

1. Be cautious with links and use strong antivirus software

Don’t click on links in unsolicited texts or emails, even if they look official. Use a strong antivirus or mobile security app to help block malicious links and detect potential threats. The best way to safeguard yourself from malicious links that install malware, potentially accessing your private information, is to have antivirus software installed on all your devices. This protection can also alert you to phishing emails and ransomware scams, keeping your personal information and digital assets safe.

Get my picks for the best 2025 antivirus protection winners for your Windows, Mac, Android and iOS devices at CyberGuy.com/LockUpYourTech.

2. Filter suspicious messages automatically

Enable spam filters in your phone’s messaging settings. Most modern smartphones have built-in options to block known scam numbers and filter unknown senders.

3. Add an extra layer of account security

Use two-factor authentication (2FA) on your banking, email, and financial accounts. Even if a scammer gets your login info, 2FA makes it harder for them to access your data.

4. Remove your personal info from data broker sites

Use a personal data removal service to reduce the amount of personal information available about you online. Scammers often pull names, phone numbers and even bank affiliations from these public databases.

While no service can guarantee the complete removal of your data from the internet, a data removal service is really a smart choice. They aren’t cheap – and neither is your privacy. These services do all the work for you by actively monitoring and systematically erasing your personal information from hundreds of websites. It’s what gives me peace of mind and has proven to be the most effective way to erase your personal data from the internet. By limiting the information available, you reduce the risk of scammers cross-referencing data from breaches with information they might find on the dark web, making it harder for them to target you.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Check out my top picks for data removal services and get a free scan to find out if your personal information is already out on the web by visiting Cyberguy.com/Delete.

Get a free scan to find out if your personal information is already out on the web: Cyberguy.com/FreeScan.

5. Stick to verified sources

Only use the official Chase app or website to check your account or respond to alerts. Never trust links sent via text or email unless you’ve confirmed their legitimacy.

6. Slow down when messages feel urgent

Stay cautious with any message that pressures you to act immediately or share personal details. Scammers use urgency to short-circuit your judgment.

7. Regularly monitor your bank activity

Even if you haven’t clicked anything suspicious, make it a habit to check your accounts regularly for unusual transactions.

8. Educate family members, especially older adults

Scammers often target people who may not be familiar with digital threats. Share these tips with parents or grandparents to help them stay safe too.

Kurt’s key takeaways

Bill made the smart move. He didn’t click the link and confirmed the message with Chase. That one step helped him avoid what could have been a serious security issue. Scammers are using more realistic tactics every day, but you don’t have to fall for them. When something feels off, trust your instincts. Always go straight to the source, and never let urgency rush you into clicking a suspicious link.

CLICK HERE TO GET THE FOX NEWS APP

Do you think banks and the government should be doing more to prevent scam texts and protect consumers from phishing attacks? Let us know by writing us at Cyberguy.com/Contact.

Sign up for my FREE CyberGuy Report

Get my best tech tips, urgent security alerts, and exclusive deals delivered straight to your inbox. Plus, you’ll get instant access to my Ultimate Scam Survival Guide – free when you join my CYBERGUY.COM/NEWSLETTER.

Copyright 2025 CyberGuy.com. All rights reserved.