Digitally Generated Image , 3D rendered

getty

U.S.–China Rivalry Moves Beyond Chips

The rivalry between the United States and China over artificial intelligence has evolved from a race for technological superiority into a contest over global governance, digital standards, and the future architecture of the internet.

This marks a substantial U.S. policy failure that threatens America’s global dominance of this increasingly critical technology.

While the U.S. has largely focused on containing China’s rise through export controls and bolstering its domestic industry, Beijing is pushing a competing vision: one rooted in multilateralism, open access, and a strong appeal to countries in the Global South.

Export Controls Backfire

Washington’s export restrictions on advanced semiconductors—intended to hobble China’s AI development—have had unintended consequences. Rather than stalling progress, they’ve helped spark a dual-track response from Beijing. On one front, black-market smuggling networks have emerged, funneling restricted chips into the country. On the other, China has doubled down on industrial policy, accelerating domestic innovation at a pace few anticipated.

The result: a resilient, increasingly self-sufficient Chinese AI ecosystem that validates the country’s state-led development model. What began as a containment strategy has instead helped catalyze China’s long-term ambitions.

A Fracturing Global AI Landscape

These opposing approaches are shaping two divergent AI ecosystems. China is building one around open-source models and locally optimized hardware, backed by active diplomacy. The U.S., meanwhile, promotes a closed, proprietary model tied to its hardware dominance.

This split is about more than just technology—it signals a deepening geopolitical divide. Countries will soon face pressure to choose not just which tools to adopt, but which norms, standards, and alliances to embrace.

China’s Push for AI Governance Leadership

Chinese Premier Li Qiang is seen on a screen as he speaks at the opening ceremony of the World Artificial Intelligence Conference in Shanghai on July 26, 2025. (Photo by Agatha Cantrill / AFP) (Photo by AGATHA CANTRILL/AFP via Getty Images)

AFP via Getty Images

In July, Premier Li Qiang formally proposed the creation of the World Artificial Intelligence Cooperation Organization (WAICO), aimed at giving China a central role in setting global AI rules. The pitch came just days after the Trump administration released its own AI roadmap, focused on cementing U.S. dominance.

Beijing’s plan emphasizes inclusivity, positioning AI as a shared global resource rather than a commodity monopolized by a few countries. Li described the initiative as “open to all sincere and willing participants,” aiming to win over countries long excluded from Western-led governance frameworks.

Competing Philosophies

At the heart of this contest is a clash of political ideologies. The Trump administration’s Winning the AI Race: America’s AI Action Plan promotes deregulation, private-sector innovation, and the global spread of the “American AI Technology Stack.”

By contrast, China is leveraging multilateral institutions like the United Nations and the International Telecommunication Union to push for a more centralized and consensus-driven framework—one that it can steer from within.

For the developing world, China’s model, with its emphasis on open access and shared benefits, may offer a more attractive alternative to what they view as America’s zero-sum approach.

The Global South: A Diplomatic Battleground

Pedestrians pass by a Huawei Technologies Co. mural painted on a wall in Lusaka, Zambia, on Tuesday, Dec. 11, 2018. Most of the digital infrastructure projects in Zambia, like the more visible airport terminals and highways, are being built and financed by China, putting the country at what the International Monetary Fund calls a high risk of debt distress. Photographer: Waldo Swiegers/Bloomberg

© 2018 Bloomberg Finance LP

China’s growing influence in the Global South isn’t just rhetorical. Through the Digital Silk Road—a core part of the Belt and Road Initiative—Beijing is laying physical and digital infrastructure across Africa, Southeast Asia, and Latin America. These include data centers, telecom networks, and e-commerce platforms, many of which are bundled with Chinese AI technologies.

By offering lower-cost, open-source AI tools—and tying them to its infrastructure investments—China is creating deep, durable ties that are as much about geopolitics as they are about code.

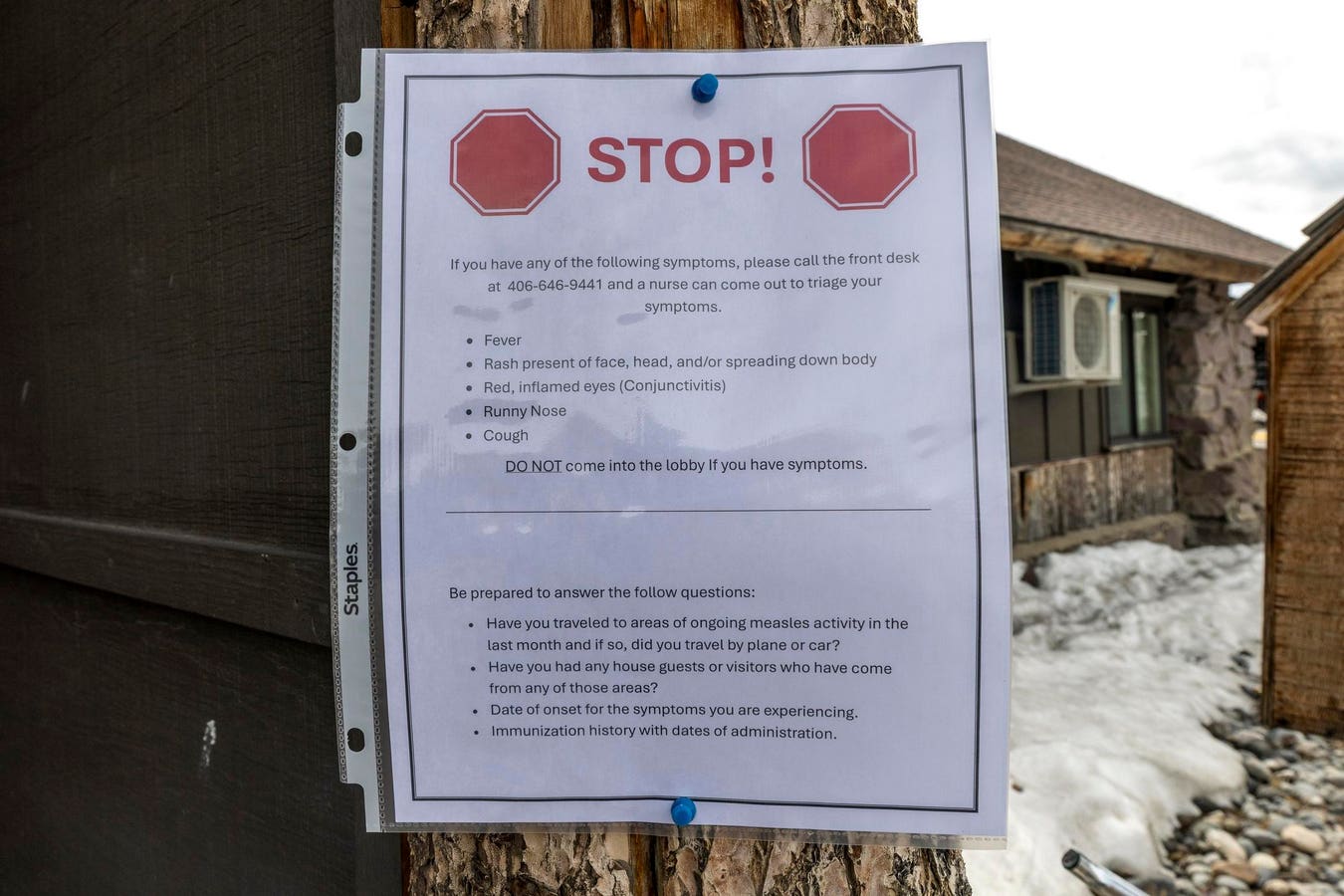

A Two-Front Semiconductor Strategy

Despite U.S. export controls, a steady stream of high-end chips continues to reach China through shell companies, re-export hubs like Malaysia and Singapore, and falsified shipping documents. In 2024 alone, hundreds of thousands of advanced chips—including Nvidia GPUs—were reportedly smuggled into China, according to the Center for a New American Security.

The U.S. has responded with the proposed Chip Security Act, which would require location-verification features in export-controlled semiconductors. But this has only heightened Beijing’s suspicion of backdoors and surveillance, prompting some Chinese firms to abandon American chips altogether.

Domestic Innovation Accelerates

Sanctions have also fueled a massive investment surge at home. Flagship firms like Semiconductor Manufacturing International Corporation (SMIC) are now ramping up 7nm production, while Huawei’s HiSilicon division is rolling out competitive AI chips like the Ascend 910C. While still behind the global cutting edge, these chips reportedly rival Nvidia’s H800 and H20 in performance—especially since those U.S. chips are now subject to restrictions or redesigns.

One of the more telling developments is the software shift underway. Leading Chinese startup DeepSeek has begun optimizing its AI models for a new data format tailored to next-generation domestic chips—signaling a deliberate move away from the Nvidia ecosystem.

Embargo Turns Into Catalyst

SHANGHAI, CHINA – MAY 03: Cambricon Technology CEO Chen Tianshi speaks during the cloud artificial intelligence (AI) chip named Cambricon MLU100 launching ceremony on May 3, 2018 in Shanghai, China. Cambricon MLU100 is the first self-developed cloud AI chip in China. (Photo by Visual China Group via Getty Images/Visual China Group via Getty Images)

Visual China Group via Getty Images

Companies once struggling under U.S. blacklists—like Cambricon—are now posting record profits, boosted by protected market demand and generous state support. The embargo has become a rallying point, uniting policy, capital, and talent behind the goal of technological independence.

Rather than halting progress, U.S. policy has sparked a feedback loop: the more restrictions Washington imposes, the more China invests, innovates, and recruits. The very effort meant to stall its ascent is accelerating it.

Nvidia’s Dilemma

Caught in the crossfire is Nvidia, which continues to rely heavily on the Chinese market. To comply with U.S. rules, the company developed “export-safe” chips like the H20, stripped down just enough to avoid triggering bans. AMD followed with its MI308.

In early 2025, the Trump administration briefly halted even these modified chips—only to reverse course under a controversial arrangement: chipmakers would be allowed to sell again, but must hand over 15% of their China-derived revenues to the U.S. government. The move was seen by some as a de facto tax on cross-border commerce, and by others as an implicit acknowledgment that a full decoupling is neither practical nor profitable.

What Comes Next

The AI divide between China and the U.S. is no longer just a matter of compute or code—it’s a clash of worldviews. America bets on innovation and the private sector. China counters with state planning, infrastructure diplomacy, and multilateral outreach.

The outcome won’t just decide which country’s chips power the next generation of AI. It will shape who writes the rules—and who gets to play.