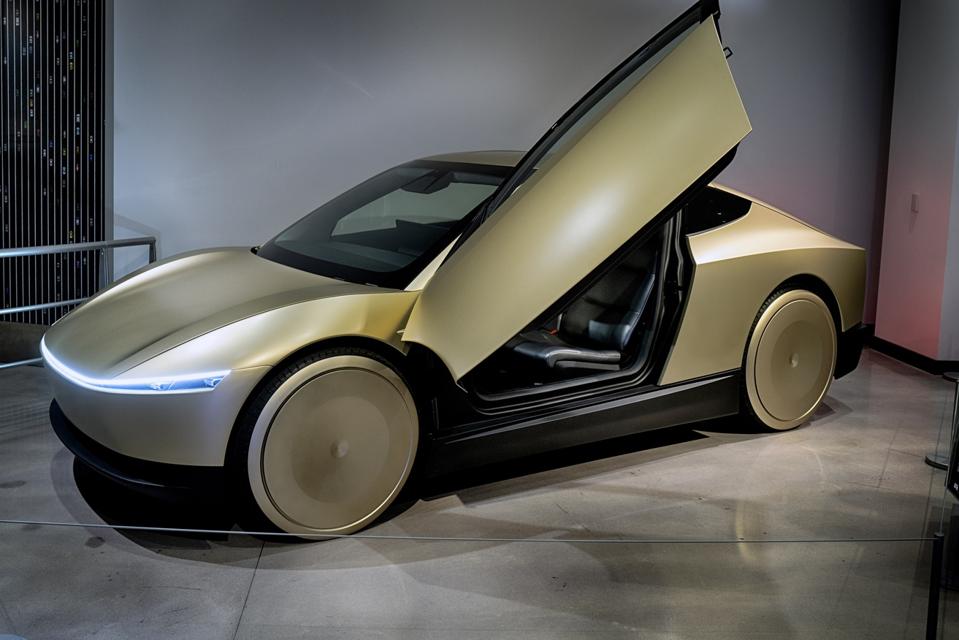

Tesla hopes this two-seater stripped down “Cybercab” will make the lowest cost robotaxi to help them compete

Copyright 2024 The Associated Press. All rights reserved.

Tesla hopes to have a robotaxi, and has made serious efforts to make it cheaper to manufacture. Their pilot deployments, which are not yet robotaxis as they require full time human supervision, are done in stock Tesla models Ys, costing around $55,000 to retail customers. Most other players have paid minimal attention to cost, loading up vehicles with high-cost sensors and computing, with cost estimates over $150,000 per vehicle. This difference may, it turns out, mean little, at least for the first several years.

Tesla says their Cybercab design, with 2 seats, no controls, just cameras for sensing and a Tesla-designed computing chip, with a minimalist interior, will be made for about $30,000. Baidu Apollo says their design, which is now in use costs $28,000 to build. Amazon’s Zoox uses a specialized custom design currently made in small volumes that will have a very high price to start. Waymo’s new Zeekr design uses a $40,000 base vehicle–or it was before Biden’s tariffs and now Trump’s–and is estimated to add $30,000 of gear. Their Hyundai design will be somewhat more. Tesla has also recently suggested that when they offer the Cybercab to retail customers, it will have a wheel and pedals.

How could these big price differences be unimportant?

Vehicle cost (ie. depreciation per mile) is indeed the largest of several components of the “cost of goods sold” for a robotaxi, but it’s only about 25% of that cost. Other elements like depots, cleaning, charging, maintenance, insurance/crashes, customer service and remote ops and more add up to the rest. The COGS determine your gross margin. If somebody uses a vehicle that costs 25% more, it’s only going to increase the total COGS/mile by 7-10%. In a mature, commodity market, this would either mean thinner margins, or slightly higher prices to customers.

Cost breakdown of various robotaxi vehicles in terms of COGS per mile. The blue bar is the vehicle depreciation, which is important, but still just 25% for typical vehicles

Brad Templeton

But we’re not in a mature, commodity market, and we won’t be for quite some time. Both because the technology is new and evolving, and because in many cities, there won’t be competition for years to come. (There won’t even be service for years to come in many towns. There are still mid-sized towns without Uber.) Where there is competition, price won’t be nothing, but it will be one of many factors. Companies that are using a more expensive vehicle will do so for a reason, usually a reason that seeks to attract more customers. Zoox’s custom vehicle is expensive, but it offers bidirectional driving, face to face seating and big side windows. Zoox hopes that customers will prefer their vehicle, even at a slightly higher price. Waymo’s Jaguars are luxury vehicles with leather seats, more like UberComfort or even UberBlack, which customers pay more for.

Today, of course, the extra sensors and computing make an overwhelming difference. The companies with these sensors (notably LIDAR) have operating unsupervised robotaxis, and have for 6 years in the case of Waymo. Nobody without a LIDAR has a working robotaxi; they just hope to. You can’t get a bigger difference than that, and everybody hopes for what is a literal first mover advantage.

Costs Drop

If the cost is found in sensors and other digital electronics, we know what happens to the price of such things with time and scale–they plummet, and I mean really plummet, by orders of magnitude. With other car parts, it’s a miracle to make them 20% cheaper. With digital electronics it’s very strange if they don’t get 10 times cheaper, in some cases a billion times cheaper.

Tesla is good at making cars, though the Chinese are better at making them cheaper. Only tariffs prevent the Chinese automakers from winning any price war, and that’s not a long term answer. There are a few other costs which can come down–Tesla hopes to reduce the cost of mapping, but that’s a very small component of the COGS. They are the leader in charging, though they have selected a totally new charging approach for the CyberCab, putting them on an even footing with the others who also must find automatic charging methods.

Tesla hopes their all-camera approach will work. If it does, then the expensive sensors in all the working robotaxis no longer provide any advantage, they are cost with no benefit. The others bet that’s not the case. If their bet turns out to be wrong, the question will be how readily they can change their approach, and what it costs them. The attraction of the camera-only approach is that it is, in some ways, simpler, and mostly machine learning. Duplicating it will not be too hard for experienced companies, but testing and certifying will take time. They’ll have all the other components of a service in place, though, and of course their old technology will still be working, just costing more than it should, which investors must handle.

Car Replacement and Private Cars

At the price of current ride-hail services, which is around $2.50/mile, a dime in extra COGS isn’t a big isue. That changes in other markets. The biggest market for the technology is a subscription service which convinces customers to give up ownership of at least one car in favor of the subscription. Here price matters more, because the subscription must be priced competitively with private ownership, which cost around $12,000/year, plus parking, according to AAA. That’s pushing $1/mile, though it drops a lot as a car gets older. As long as the car and service are good, the lower the cost of building the car, the better.

This is also true for privately owned self-driving cars, where drivers are cost sensitive, and base hardware costs are usually tripled in retail costs. Making a consumer self-driving car is much harder than making a robotaxi, and while a few have intentions, nothing is solidly on the horizon other than Tensor’s high-end vehicle (unless you believe Elon Musk’s normally wrong predictions.) Indeed, Tesla said for years their HW3 cars had all the necessary hardware but have walked that back.

This market comes later, and gets big even later. Robotaxis come sooner, but at first, they are not competing on price, in fact they’re probably not competing that much at all, instead being the only vehicle in a given city until there are multiple strong players going after each other. Years from now, as competition heats up, vehicle cost will start to play a competitive role, but everybody’s vehicles, computers and sensors will all look fairly different by then, too.