A new class of AI service clouds—GPU clouds and so-called neoclouds—have stormed the market and drawn investor interest. Before we get too excited, however, we should take a close look at how these neoclouds came to exist, what risks they hold, and what the future might have in store.

GPUs are now part of the lifeblood of the AI market, churning out compute processing for training AI models as well as delivering results—the step known as inferencing. Huge demand over the past few years has resulted in a shortage of GPUs, driving some infrastructure providers to hoard GPUs and build strategies to supply additional AI compute.

Because GPUs are often out of reach for enterprises as well as many types of service providers and cloud providers, the shortage and relatively high cost of GPUs has led to the creation of GPU-as-a-service, in which cloud providers rent out their GPU capacity. An entire market has sprung up, including the neoclouds, which are specialized GPU clouds that emerged from the cryptomining industry.

As we will explain, this has created some unique dynamics. As AI demand grows, financing for this infrastructure has exploded. This market is complicated, with many interdependencies. There have of course been discussions of a potential bubble, but it might be more nuanced than that. Let’s dive in.

What’s in a Neocloud?

Futuriom research into the GPU cloud and neocloud market shows that several themes are taking hold in the market. Traditional hyperscaler clouds, as well as another segment of the market referred to as alternative clouds, are building out their own GPU cloud services while at the same time contracting with neoclouds for spare capacity.

The neocloud trend emerged in the 2023-2024 timeframe, along with the term neocloud, which cannot be directly sourced but is said to have originated with a nod to the character Neo from the movie The Matrix.

Most neoclouds started by offering GPU capacity to cryptocurrency miners. As that market cooled, some of them, notably CoreWeave, began repurposing those GPUs toward AI processing. This started a trend of crypto miners converting compute services to GPU-as-as-service.

For the hyperscalers, the neoclouds present a convenient diversification and supply strategy. Datacenters are not easy to acquire or build, and these neoclouds represent available resources. At the same time, the hyperscalers have high profit margins and solid balance sheets, so they can help finance additional GPU clouds while outsourcing the risks involved in building the infrastructure.

At the same time, there are also alternative clouds, including companies such as Cloudflare or Vultr, which have a more diversified set of cloud services but also offer GPUs.

The Circular Nvidia Question

The evolution of the GPU market has led to a complicated, interconnected ecosystem. For example, Microsoft has invested in and has supplier deals with many neoclouds, including CoreWeave, Nebius, and Nscale. And this week, it announced a new $10 billion contract with GPU cloud provider IREN.

Microsoft isn’t alone. Nearly all the major cloud suppliers have deals with neoclouds, as do the suppliers of GPUs, which have a vested interest in selling them more chips. Nvidia, which is a major GPU supplier, has played no small role in keeping the neocloud economy humming, having invested in CoreWeave, Lambda, Nebius, and Nscale. Some of that money goes back to Nvidia in the form of chip purchases, of course.

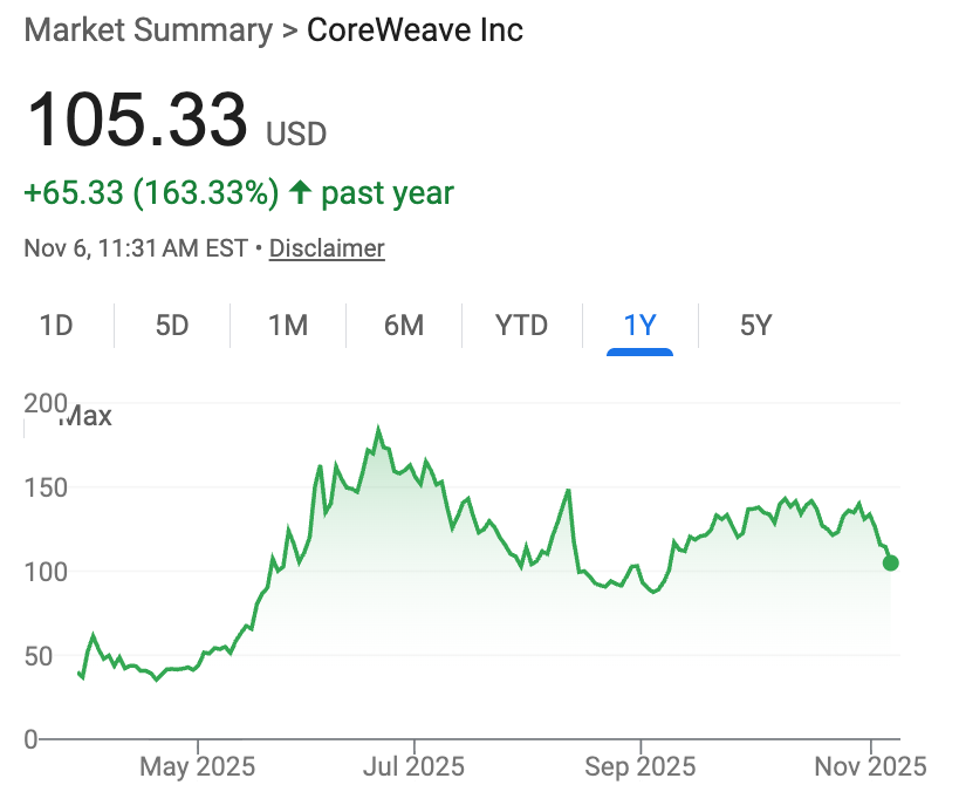

The momentum accelerated when CoreWeave went public in March of 2025 and served to elevate the visibility of GPU clouds. It now has a market cap exceeding $60 billion.

Corewave went public in March of 2025, raising $1.5 billion. But since then, it has been volatile and added to its debt levels.

This circular economy is uncomfortable and raises questions of a bubble, but from the perspective of Nvidia, it makes a lot of sense. The GPU clouds enable the continued growth of large language model (LLM) developers—particularly OpenAI—which in turn drives more consumption of Nvidia products, as well as GPU clouds. By seeding more companies to consume its chips, Nvidia has built a large ecosystem. Yet, competitors are also gaining momemtum by providing alternatives.

There is also the question of OpenAI, which may be key to the whole thing. OpenAI has pledged hundreds of millions of dollars to build out GPU infrastructure. Its partners include Amazon, Microsoft, Oracle, and Project Stargate. But there’s a huge difference between OpenAI and the hyperscalers or even Nvidia: The others already have huge amounts of money and cash flow, but OpenAI does not. Most of its pledges are based on it raising more money. The GPU market’s heavy dependence on one private company, which is losing money, poses big risks to the market.

How Big Is the Neocloud Bubble?

So how big is this thing? Answer: Big. We count about 15 neoclouds that matter, even though there are dozens of others in the market. Some of the more prominent neoclouds include CoreWeave, Crusoe, Lambda Labs, Nebius, Nscale, TogetherAI, and TensorWave. In addition to these neoclouds, major hyperscalers Amazon, Google, Microsoft Azure, Oracle, and IBM all provide GPU cloud services. And on top of that, alternative clouds such as Cloudflare and Vultr have built out GPU cloud services.

The frightening part of the neocloud evolution is that funding has now shifted from equity financing to debt financing, a strategy undertaken even by large public companies such as Oracle, which has pledged to build out hundreds of billions of dollars in GPU infrastructure backed by at least $50 billion in new debt.

The rapid pace of growth that is not yet backed by profits has called for lots of funding and lots of debt financing. In the table below, we see that six key neoclouds have raised about $10 billion in equity financing and more than $32 billion in debt financing.

The top neoclouds have attracted more than $32 billion in debt financing, raising the risks to the financial system.

Futuriom.com

But this just scrapes the surface. Deals are now being announced nearly every day.

Are Hyperscalers Outsourcing Risk?

Much has been written about the “circular AI economy,” but not only is the GPU cloud economy circular, it is shrouded in complicated finances.

Here’s how I look at it: The hyperscalers are in an arms race to build GPU clouds, but with their capex-to-revenue hitting historic highs, investors may soon start pushing back. Neoclouds have sprung up to provide some additional infrastructure.

In addition, GPU clouds are expensive and complicated to build. They require regulatory clearance, land, power, and water—not exactly the business that many cloud providers want to be in. The neoclouds have sped up the building of this infrastructure, providing cheaper financing with their balance sheets. They provid outsourced risk and headaches for other clouds.

Nobody has any idea how far the growth in the GPU market will go, but traditionally hardware and infrastructure has been cyclical. To make it even more complicated, GPUs depreciate on a 4- to 6-year cycle, so these businesses are also racing against time. If the macro economy or AI economy slows in the next couple of years, some people will be left holding the bag. Very few of these projects have yet to be profitable.

If things start to go south, the major cloud providers will likely take a hit, but they can probably walk away from many of the obligations. Some of the debt for GPU investment has been shifted to others.

Even more uncomfortable is the thought that some companies have become “too big to fail.” CoreWeave is on track to report net losses exceeding $1 billion in 2025—but its future also appears secure, because Nvidia has agreed to purchase all unused CoreWeave capacity up until April 2032, a deal worth $6.3 billion initially, CoreWeave says.

Here’s our summary of what to watch in the neocloud market:

- The need for GPU power is driving AI cloud expansion. The heated competition to build more AI capacity is primarily a race to lock down power guarantees.

- This new market is driving the evolution of a new infrastructure stack with needs in networking, storage, and security. Each layer of the infrastructure has new demands to support the scale and complexity of hosting AI clouds.

- Debt is starting to outweigh equity in neocloud funding. The scale is tipped by companies like CoreWeave. The debt usually goes toward buying GPUs, but for those neoclouds that are building datacenters themselves, the debt also finances construction projects.

- Hyperscalers are implementing diversification strategies to offset risks. Chip and networking companies are courting neoclouds with alternatives—and hyperscalers are diversifying suppliers to make sure they aren’t overdependent on specific AI chips or cloud infrastructure.

In summary: I wouldn’t expect the neocloud or GPU cloud market to have a simple and uncomplicated future. Buckle up. It will get interesting.

Next week, I’ll post a second part of this series delving into the differentiation among the major hyperscaler and neocloud GPU strategies.

Futuriom provides paid research and marketing services to technology companies, with the goal of providing accurate insight into how cloud and AI infrastructure markets are evolving. These services include subscription research, custom research, and report sponsorships. In the past twelve months, Futuriom has not done any business with the companies mentioned in this article. The author holds no positions in individual technology stocks mentioned in this article.