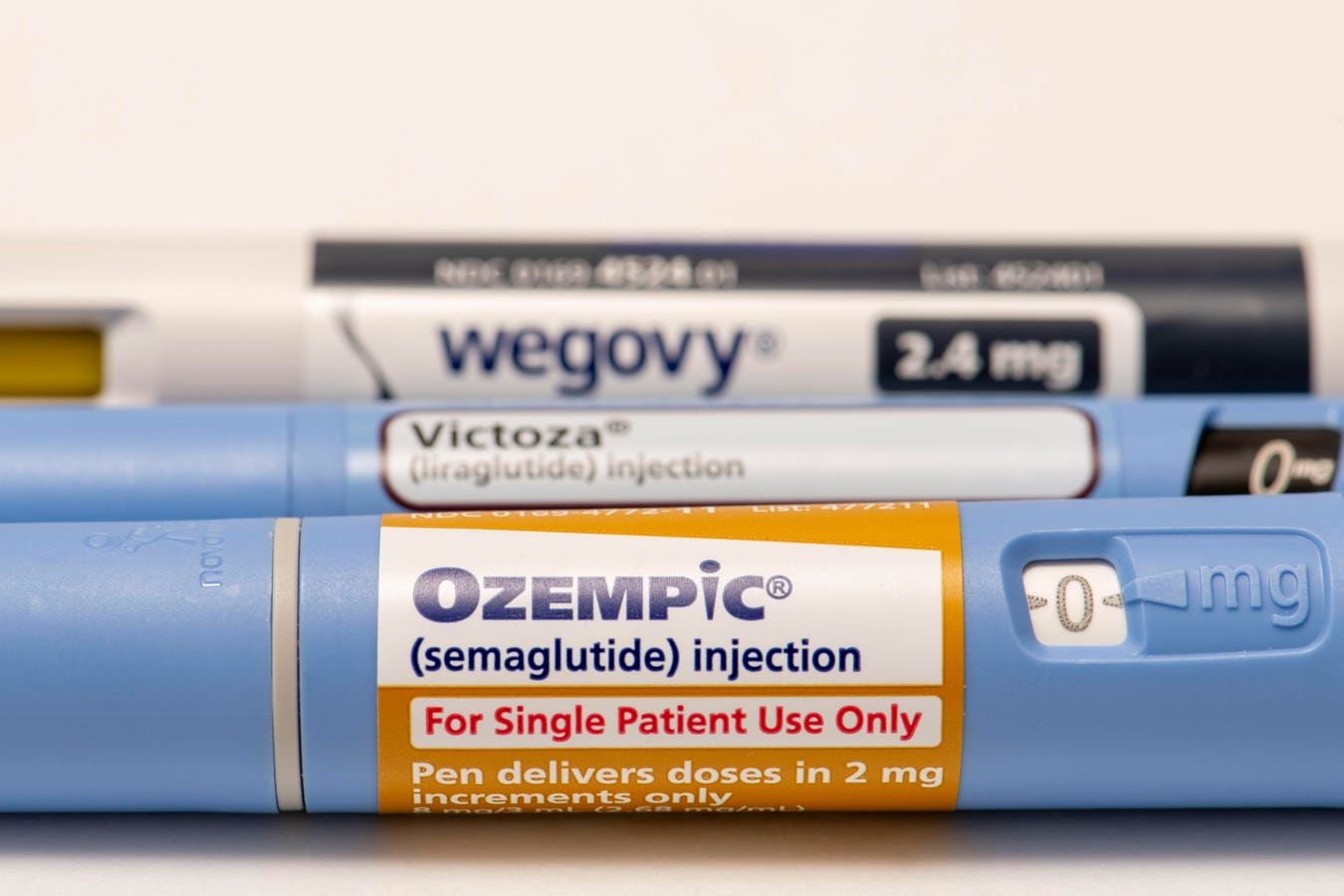

As the popularity of Ozempic, Victoza, Wegovy and other GLP-1 agonists have continued to increase, … More

This could end up making your wallet lighter if you are taking Ozempic or Zepbound for diabetes or weight loss. From 2024 to 2025, insurance coverage of Ozempic, which contains semaglutide, went down by 22%, based on GoodRx’s analyses of data from Managed Markets Insight and Technology. That meant an additional 1.1 million people no longer had such coverage for the most often filled glucagon-like peptide-1 receptor agonist. During that same time span, the number of people with no insurance coverage for another GLP-1 receptor agonist, Zepbound, increased by 14%, which meant that another 4.9 million or so more people were bound for no insurance coverage for the tirzepatide-containing Zepbound.

Demand For Ozempic, Zepbound And Other GLP-1 Agonists Continues To Increase Despite Prices

So, insurance coverage for these medications has gone down while demand for them has continued to go up and up. Another set of analyses by GoodRx of data from a nationally-representative sample of around 50,000 pharmacies across the U.S. revealed that fills for Zepbound have jumped by 300% since the start of 2024. Over that same time period the fill rate for Ozempic has doubled. The popularity of GLP-1 receptor agonists has continued to grow after it was found that taking them can result in fairly rapid weight loss.

Now Zepbound, Wegovy and Saxenda are officially approved by the U.S. Food and Drug Administration for weight loss, the FDA approval for Ozempic, Mounjaro and Victoza is for the treatment of type 2 diabetes and not weight loss. But how much do you want to bet that the boost in popularity of all of these medications is due in large part to people taking them for weight loss?

Of course, taking GLP-1 agonists is not without its potential drawbacks. I’ve already written in Forbes about not-so-great effects dubbed “Ozempic butt” and “Wegovy finger.” There are also more serious possible side effects like ileus. Moreover, it’s not completely clear what all of the longer term effects of taking these medications over and over again since studies haven’t extended over decades yet.

Plus, these medications aren’t exactly cheap without anything like insurance to offset their prices. The list price of one Ozempic injection pen is $997.58, according to its manufacturer Novo Nordisk. Meanwhile, Lilly lists the price of Zepbound to be $1,086.37 per fill. The most common way to take such medications is via weekly injections. And once you start these medications, the plan is usually to keep taking them and taking them and taking them. That’s because most if not all of the weight lost tends to return soon after you stop these medications. That mean’s these costs can add up quickly to over $1300 a month. Therefore, it would make sense to see if your health insurance might cover some if not all of these costs, assuming that you do have health insurance.

Insurance Coverage For Ozempic, Zepbound And Other GLP-1 Agonists Is Complex And Changing

If you are looking for an example of something simple, few people would say, “How about health insurance?” It can be difficult to figure out what’s covered and not covered by a given health insurance policy. Paying for a medication with health insurance is not always like buying a Ryan Reynolds pillow case on Amazon, where everyone can see the price and then choose whether to move forward based on that and how much of Reynold’s chest you can see. The GoodRx analyses broke down insurance coverage for GLP-1 receptor agonists into the following three categories:

- No coverage: This means you are on your own to find some way to pay for the medication.

- Restricted coverage: Here the insurance company imposes some sort of requirements for you to satisfy before coverage may be possible. You may have to get “prior authorization,” meaning that the insurance company will review your case and say “yeah” or “nay” or ask that you try some other treatment first. All of this can be a pain in the you-know-where. So, people may get frustrated and just go ahead and pay for the medications themselves.

- Unrestricted coverage: This is sort of the Holy Grail for insurance policy holders. The insurance just goes ahead and pays for the medication. Of course, this doesn’t necessarily mean that the insurance will make it easy on you. It may still not cover the full price. Plus, you may be required to meet a deductible first before insurance coverage kicks in completely.

So for Zepbound, since 2024, the percentage of people having unrestricted coverage jumped from 9% to 13%. At the same time though, the percentage with restricted coverage dropped from 73% to 66%. The net was the 14% losing insurance coverage mentioned earlier.

Two medications, Victoza and Saxenda, that contain liraglutide, another GLP-1 receptor agonist, also suffered decreases in commercial insurance coverage. The percentage of people without insurance coverage for Victoza went up by 92% since 2024, corresponding to 31 million people. Meanwhile, the percentage change for Saxenda was 47% or 31 million people. At the same time, the number of people having to deal with restrictions on their insurance coverage for Victoza went up by 22%. The new availability of generic liraglutide may have prompted these changes, as at least 9.5 million people gained coverage for the generic form in 2025. However, it’s not as if it was all-clear for generic liraglutide either as the number of people with restrictions on their insurance coverage of this stuff mushroomed by 32%.

At the same time, access to Wegovy, again one of the meds actually FDA-approved for weight loss, did benefit from a little bit more insurance coverage. Compared to 2024, the percentages of folks with unrestricted coverage went from 14.2% to 14.6%, benefiting at least 600,000 people. and the percentage of folks with restricted coverage went from 67% to 71%, benefiting at least 6.3 million people. That meant things better insurance coverage-wise for over 7 million potential users of Wegovy in 2025. All in all, though, over 82% of folks face some type of restriction on their insurance coverage for Wegovy, Zepbound, and Saxenda, the three GLP-1 agonists FDA-approved for weight loss.

Insurance Coverage For Ozempic, Zepbound And Other GLP-1 Agonists Will Be A Growing Concern

UnitedHealthcare, which is the largest health insurer in the U.S. covering over 50 million lives, … More

With the increasing use of GLP-1 agonists, it’s not surprising that insurance plans have imposed more restrictions on their coverage. After all, many insurance companies are for-profit companies, meaning that making profits is probably pretty high on the list of things that they want to do. Then there are the publicly traded insurance companies, which want to make money not only for themselves but also for their many, many investors.

Insurance companies acorss the U.S. have largely been quite successful at achieving these goals. In 2023, the National Association of Insurance Commissioners provided a 10-year snapshot of the U.S. health insurance industry’s aggregate financial results. It included the following statement: “The health insurance industry continued its profitability trend as it reported a (3%) increase in net earnings to nearly $25 billion but a modest decrease in the profit margin to 2.2% in 2023 compared to net earnings of

$24 billion and a profit margin of 2.4% in 2022.” So, it’s not as if major insurance companies have been struggling to make ends meet.

Nevertheless, insurance companies could be viewing coverage of these GLP-1 receptor agonists as threats to their bottom lines, costs that could negatively impact their profits. One could argue that helping people decrease their body weight could end up saving other medical costs, assuming that the new body weight is within a range that’s good for them health-wise. The challenge is that insurance companies may not necessarily look at such longer-term financial benefits, especially if people change insurance policies when they change jobs every few years or so.

This is an issue that won’t go away anytime soon, at least not until the prices of GLP-1 agonists drop. The entrance of more GLP-1 agonists into the market, especially generic ones, could eventually bring prices down. But until that happens, if you are interested in taking Ozempic, Zepbound or any other GLP-1 agonists, you may want to check with your insurance plan first. It could be a little light on the coverage.