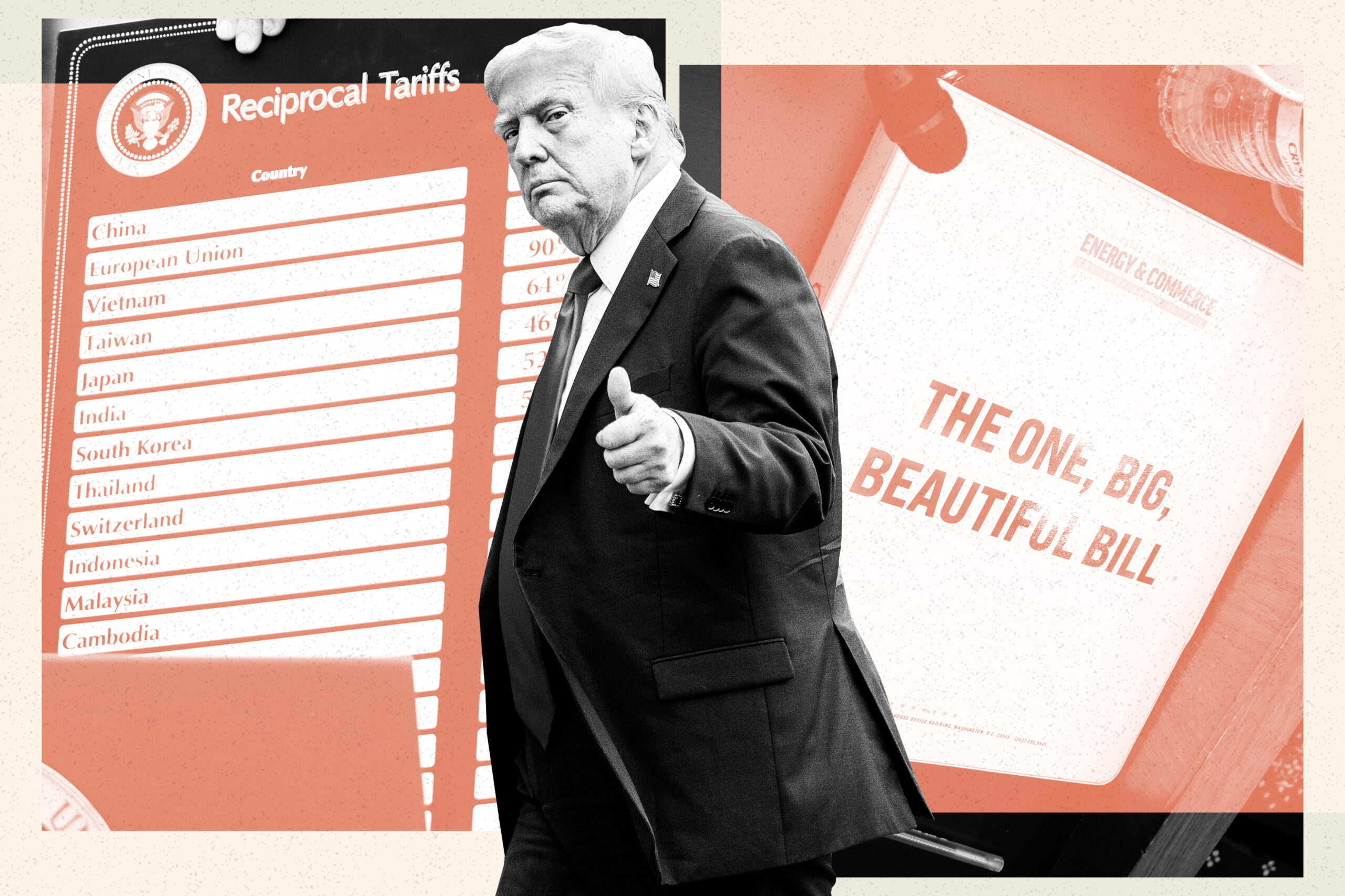

The first six months of President Donald Trump’s term have produced a cash cow of historic magnitude for the lobbying industry, with record-breaking demand for help navigating the administration’s constant stream of policy pronouncements — or trying to avoid becoming a pay-for in the GOP’s megabill.

The result is a new set of power brokerse in Trump’s swamp. Firms with strong ties to the White House have skyrocketed to the top of the pecking order of lobbying outfits in town, according to a POLITICO analysis of the latest quarterly lobbying disclosures filed this week.

No firm has benefitted more than Ballard Partners, which is led by Trump fundraiser Brian Ballard. The firm previously employed White House chief of staff Susie Wiles and Attorney General Pam Bondi. Ballard brought in $20.6 million in lobbying revenues during the second quarter of the year from clients including Palantir, American Express, TikTok, Ripple Labs and UnitedHealth. Its haul is more than four times what the firm brought in during the second quarter of 2024.

But the gusher has benefited the entire lobbying industry, new firms and old, the analysis shows. Of the top 20 firms by revenue, only two saw their lobbying revenues decline last quarter compared to the same time a year ago. The lobbying figures reported this week don’t include revenue from public affairs or consulting work, or foreign agent work.

“The number of people who feel they need representation at this point is huge, and we’re really just getting into sort of the day-to-day of governing,” said Rich Gold, who heads up the public policy and regulation group at law and lobbying firm Holland & Knight. Gold’s firm, which ranked fifth among the top earners on K Street last quarter with $13.8 million in revenue, signed 57 new clients during the first half of the year, a record intake for the firm.

“The largest driver of business right now is the overarching trend of uncertainty and the need for C-suites to try to minimize uncertainty and political risk as much as possible,” he said. While specific legislation like the recently signed One Big Beautiful Bill Act has certainly drummed up lobbying business, “the number of people who needed political intelligence work and advocacy” in D.C. this year stretches far beyond that one law, Gold said.

As for Ballard, its blowout earnings were enough to dethrone Brownstein Hyatt Farber Schreck, which has topped the quarterly revenue rankings since 2021. Brownstein reported $18.5 million in lobbying revenues during Q2, setting the firm’s own quarterly record.

Ballard’s Trump-linked competitors are also cashing in. Miller Strategies, which is run by top GOP fundraiser Jeff Miller and employs several former Trump administration alumni, brought in nearly $13 million during the second quarter from clients like Zoom, OpenAI, Apple, Softbank, Crypto.com and Blackstone. That’s up almost 80 percent from the beginning of the year, and four times what it brought in during the second quarter of 2024.

Continental Strategy, whose staff includes former Trump appointee Carlos Trujillo as well as a former top aide to then Sen. Marco Rubio, reported $6.5 million in lobbying revenues last quarter, making it the 15th biggest firm by lobbying revenue in Q2. During the same time last year, Continental reported just $292,000 in lobbying fees.

Another firm that found itself knocking at the doorstep of D.C.’s most prestigious lobbying shops didn’t even exist in the nation’s capital a year ago.

North Carolina-based Checkmate Government Relations, which announced plans to open a D.C. office in December, brought in $4.5 million in lobbying fees in Q2, more than quadruple the $910,000 it reported at the beginning of 2025. Among its clients were Eli Lilly, Novo Nordisk, UNC Chapel Hill, General Dynamics and Juul.

Checkmate’s president, Ches McDowell, is a hunting buddy of Donald Trump Jr. and the brother of freshman Rep. Addison McDowell (R-N.C.). The firm also employs the son of Trump’s co-campaign manager and the nephew of Trump’s HHS secretary.

BGR Group, a bipartisan but Republican-heavy firm whose alumni include Transportation Secretary Sean Duffy, posted its best quarter in its 35-year existence, said Loren Monroe, the co-head of the firm’s lobbying group.

BGR’s lobbyists include Trump adviser David Urban as well as Florida powerbroker Nick Iarossi, and the firm reported $17.7 million in lobbying fees in Q2 — which was third overall and marked a nearly 60 percent increase from the same time last year.

Mercury Public Affairs also posted a banner quarter, raking in almost $6.5 million from April through June, compared to $3.2 million in Q2 of 2024. Wiles served as a co-chair at the K Street mainstay before joining the White House this year, and the bipartisan firm also employs former Trump adviser Bryan Lanza, who’s signed dozens of new clients since the election.

Elsewhere on K Street, the all-Republican firm CGCN Group doubled its lobbying revenues compared to a year ago, and Michael Best Strategies, whose leadership includes Trump’s first White House chief of staff, Reince Priebus, and Trump’s 2024 co-campaign manager, Chris LaCivita, more than tripled its Q2 lobbying earnings.

Lobbyists anticipate the good times will last, at least for the foreseeable future, even after the signing of the megabill this month — though not everyone believes the Trump-driven realignment will remain.

“We’ve had sort of personality-based firms in town before,” said Gold. “They kind of come and go. I expect that to be the case here.”

In addition to ongoing trade policy disruptions, multiple lobbyists pointed to the various executive orders and presidential memoranda the White House has been churning out since day one as another key driver of business this year.

“The beginning of any new administration is a very busy time,” added Karishma Page, a partner at K&L Gates. “This, I think, is a high watermark.”

K&L Gates saw its lobbying revenue last quarter surge by 25 percent from the same period a year ago thanks to the flurry of activity on both ends of Pennsylvania Avenue.

“There seems to be an insatiable appetite” from clients for insight into the Trump administration, added Will Moschella, who co-leads the lobbying practice at Brownstein.

“A lot of those executive orders require departments and agencies to report back with policy proposals,” he said. “So they weren’t one time events — those are documents and directives that are going to drive further executive branch action.”

From an advocacy perspective, the fight over Republicans’ massive reconciliation package this spring and summer “is kind of like having your dessert,” Gold said. Those negotiations touched off lobbying by everyone from universities to business groups, hospitals, the renewable energy industry and beyond.

The day-to-day regulatory work at various agencies, which Gold compared to “eating your spinach,” is “really just gearing up,” he added.

There’s also the widespread uncertainty over Trump’s tariff policies, to say nothing of must-pass legislation to fund the government and reauthorize the nation’s farm and defense policies.

Those issues — while less sexy than things like crypto or AI policy — have been the focus of increased attention from clients, lobbyists said, thanks to Trump’s large-scale slashing of government funding across the country and the recissions bill passed by Congress this month.

“There is a need in the current moment to really be able to justify the work of an organization that may be a federal contractor or grantee,” Page argued.

That’s also the case for clients that have sought to avoid the president’s ire. “I think there was a sense at the beginning of the administration that maybe you could just duck and cover and just be left alone,” said Monroe. “The experience of the last six months suggests that the best defense is a strong offense … and telling your story, otherwise you risk it being told for you.”