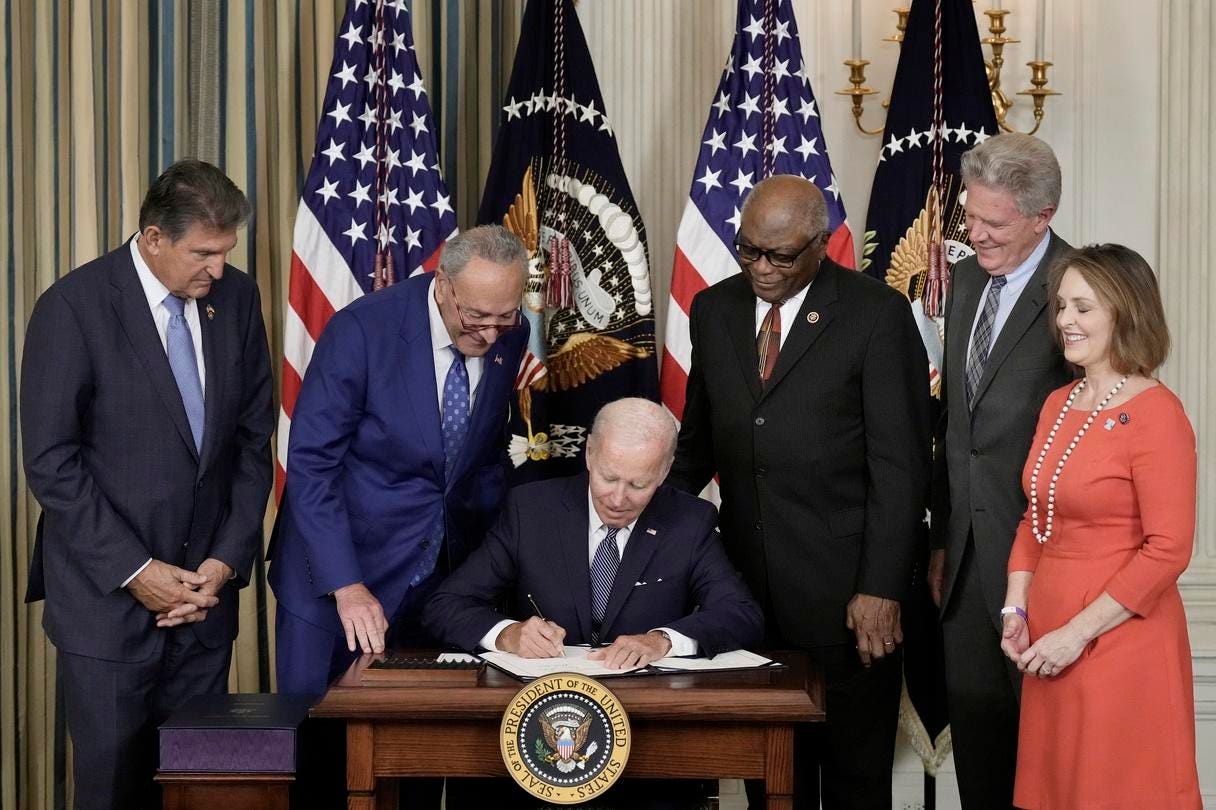

Former President Joe Biden signed The Inflation Reduction Act in the State Dining Room of the White House August 16, 2022, in Washington, DC. The $737 billion bill focuses on climate change, lower healthcare costs and creating clean energy jobs.(Photo by Drew Angerer/Getty Images)

Getty Images

Tens of thousands of Medicare beneficiaries who are cancer patients have substantially lower out-of-pocket costs for their prescription drugs, thanks to a key provision included in the Inflation Reduction Act.

When people think about the IRA’s drug pricing measures, they’re more likely to be familiar with the Medicare price negotiation aspect than the redesign of Medicare’s outpatient drug benefit. The former entails Medicare’s ability to negotiate prices of a select number of drugs. But the prices that apply to the first round of ten pharmaceuticals won’t be implemented until next year. It’s the wholesale restructuring of the pharmacy benefit that’s far more comprehensive and already having an impact on Medicare recipients, especially beneficiaries who prior to 2024 incurred more than $3,300 in annual out-of-pocket costs. These include many cancer patients. Under the IRA law, annual out-of-pocket costs were capped at $3,300 in 2024 and lower still at $2,000 in 2025.

Upon enactment of the Medicare Modernization Act in 2006, the federal government health insurance program for seniors and disabled added a prescription drug benefit called Part D. This meant that Medicare beneficiaries who chose to purchase coverage from a prescription drug plan or a fully integrated insurer offering medical and pharmacy benefits under Medicare Advantage, could better afford their outpatient medicines.

Nevertheless, problems emerged with respect to gaps in Part D coverage and relatively high out-of-pocket costs in the so-called catastrophic phase of the benefit, especially for beneficiaries taking expensive medications.

The IRA, which passed in 2022, includes a provision that aims to decrease the out-of-pocket cost burden for Medicare recipients, putting a lid on annual expenses at $3,300 in 2024 and $2,000 in 2025. This means that after a patient has spent $2,000 out-of-pocket this year, they have $0 in co-payment. Because of how expensive most branded (and even some generic) cancer medications are, many patients may reach the $2,000 maximum as early as January in a given year. But unlike in the past, they won’t incur any more out-of-pocket expenses the rest of the year.

A recently released report reveals the importance of a cap on out-of-pocket beneficiary expenses. The figure below from IQVIA shows that until 2024 when Part D instituted a cap of $3,300, the proportion of claims with zero dollars in patient co-payments was very small and nearly constant.

As Medicare Part D caps patient out-of-pocket expenses, the proportion of claims with $0 in co-pay increases dramatically.

IQVIA

There was no maximum, and consequently patient co-payments could easily add up in a given year to many thousands of dollars.

The IQVIA report also demonstrates how immediate the impact was of capping annual patient out-of-pocket expenses at $3,300 in 2024: Oncology prescription volumes rose 50% year-over-year between 2023 and 2024. In 2025, the cap lowers to $2,000, which will likely boost utilization further.

At the same time, the management of costs in the catastrophic phase has shifted away from the federal government and towards plans that manage the pharmacy benefit as well as drug manufacturers. While patients nothing out-of-pocket once they reach the $2,000 threshold and the federal government only reinsures 20% of the cost rather than 80%, drug makers and insurers pick up the slack. Starting in 2025, pharmaceutical manufacturers must cover 20% of drug costs in the catastrophic phase of the pharmacy benefit—up from 0%. And Part D plans take on 60% of costs, up from 15%.

The IRA has its share of detractors, in particular, regarding Medicare drug price negotiations which critics claim will lead to reduced levels of research and development expenditures and less pharmaceutical innovation. On Part D redesign, some analysts point to unintended consequences, such as driving up insurance premiums for Medicare recipients in Part D and an exodus of stand-alone prescription drug plans leading to reduced choice for some beneficiaries.

There’s also been an increase in the use of coverage restrictions, such as prior authorization, as payers attempt to control costs. Medicare Part D plans—managed by pharmacy benefit managers and Medicare Advantage insurers—receive a fixed payment per enrollee from the federal government and bear a portion of the financial risk for part of enrollees’ drug expenditures. Accordingly, plan administrators are induced to control costs by managing drug utilization and negotiating lower net prices. IRA changes in the design of the pharmacy benefit have enhanced the incentives to contain costs as much as possible. However, because all cancer medications must be covered, plans have less leeway to impose restrictions.

It’s hard to argue that Medicare Part D redesign doesn’t help oncology patients with high out-of-pocket costs. Medicare beneficiaries who were once heavily burdened financially and sometimes abandoned scripts due to cost are now able to (re)start and stay on their medication regimen.