Big Data

Meta’s $14.3 billion investment in Scale AI represents the social media giant’s most significant move to secure high-quality training data for artificial intelligence models. The deal gives Meta a 49% stake in the data labeling startup while bringing Scale AI founder Alexandr Wang into Meta’s leadership to head a new superintelligence research lab.

This acquisition addresses Meta’s most pressing challenge in the AI race: access to the specialized datasets required to train competitive large language models. While competitors like OpenAI lead the global AI market share through ChatGPT, Meta’s recent Llama 4 models received lukewarm reception from users who reported poor performance in coding tasks and generic responses compared to smaller rivals.

The Data Foundation Problem

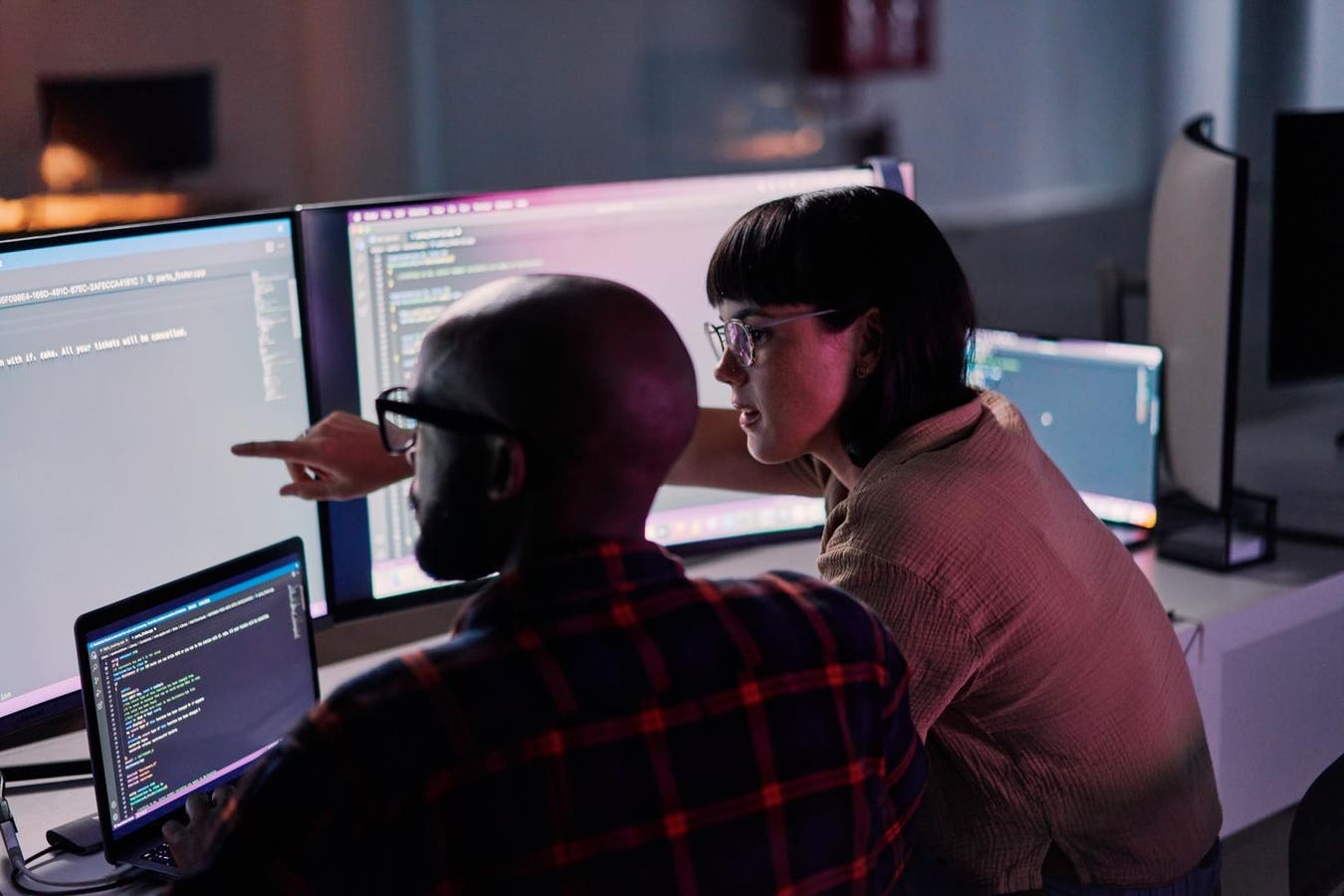

Scale AI operates a global workforce of contractors across Kenya, the Philippines and Venezuela who manually label images, text and video for machine learning applications. The data labeling process involves human annotators identifying objects in images, transcribing audio or categorizing text to create the training datasets that teach AI models to recognize patterns. For autonomous vehicle applications, this includes labeling 3D point clouds from lidar sensors and marking objects across video frames. In natural language processing, workers rate the quality of AI responses and provide feedback through reinforcement learning techniques that incorporate human feedback.

Meta’s investment secures privileged access to these data preparation services while its competitors face potential service restrictions. Google paused multiple Scale AI projects within hours of the announcement of the Meta deal. OpenAI confirmed it was already winding down its Scale AI relationship, and Elon Musk’s xAI halted some projects as well.

Market Disruption and Competitive Response

Scale AI differentiates itself through its integrated platform capabilities, which combine data labeling, model evaluation, and synthetic data generation. The company’s workforce includes highly educated and skilled contractors with PhDs and master’s degrees. This expertise proves critical for complex domains like healthcare, finance and legal services that require a nuanced understanding beyond basic image recognition.

The Meta investment creates immediate market consolidation as Scale AI’s major clients seek alternative providers. This shift benefits competitors like iMerit, which leverages domain expertise in healthcare and geospatial applications, and automated labeling platforms such as Snorkel AI that reduce dependence on human annotators.

Technical Integration and Capabilities

Wang will lead Meta’s new superintelligence lab focused on developing artificial general intelligence. The 28-year-old MIT dropout previously worked at high-frequency trading firm Hudson River Trading before founding Scale AI in 2016. His team of approximately 50 researchers will join Meta’s existing AI workforce as the company plans to spend a significant amount on AI infrastructure in 2025.

The integration provides Meta with several technical advantages. Scale AI’s data engine processes multiple modalities, including text, images, video and audio, through both automated systems and human oversight. The platform features quality assurance mechanisms that utilize statistical sampling to identify edge cases, resulting in a substantial reduction in revision cycles.

Meta’s access to Scale AI’s government contracts also expands its reach into defense applications. Wang’s connections in Washington could help Meta secure federal AI projects, diversifying beyond its consumer-focused social media platforms.

Strategic Implications for Enterprise AI

The deal structure avoids traditional acquisition scrutiny by maintaining Scale AI as an independent entity while giving Meta operational control. This approach mirrors Microsoft’s OpenAI investment and Amazon’s Anthropic backing, allowing tech giants to access AI capabilities without triggering antitrust reviews.

For enterprise technology leaders, Meta’s move signals the critical importance of data quality in AI implementations. Nearly all business leaders report encountering AI-related data quality issues, with problems including duplicate records, privacy constraints and inefficient integration hampering deployment goals. The Meta-Scale AI partnership demonstrates that even well-funded companies struggle with the foundational data challenges that determine AI success.

The investment also highlights the growing strategic value of specialized AI infrastructure. While enterprises often focus on model selection and deployment, the quality and diversity of training data ultimately determines system performance. Companies that secure reliable data labeling capabilities gain sustainable competitive advantages in AI applications.

Meta’s willingness to pay $14.3 billion for a data services company reflects the market reality that high-quality training data has become the primary constraint on AI development. As the global AI market continues expanding, access to specialized data preparation capabilities will increasingly separate successful AI implementations from failed projects.

The deal positions Meta to compete more effectively against OpenAI and Google by addressing its most significant disadvantage: limited access to the diverse, high-quality datasets required for advanced AI model training. Whether this investment translates into improved AI products remains dependent on Meta’s ability to integrate Scale AI’s capabilities with its existing research and development efforts.