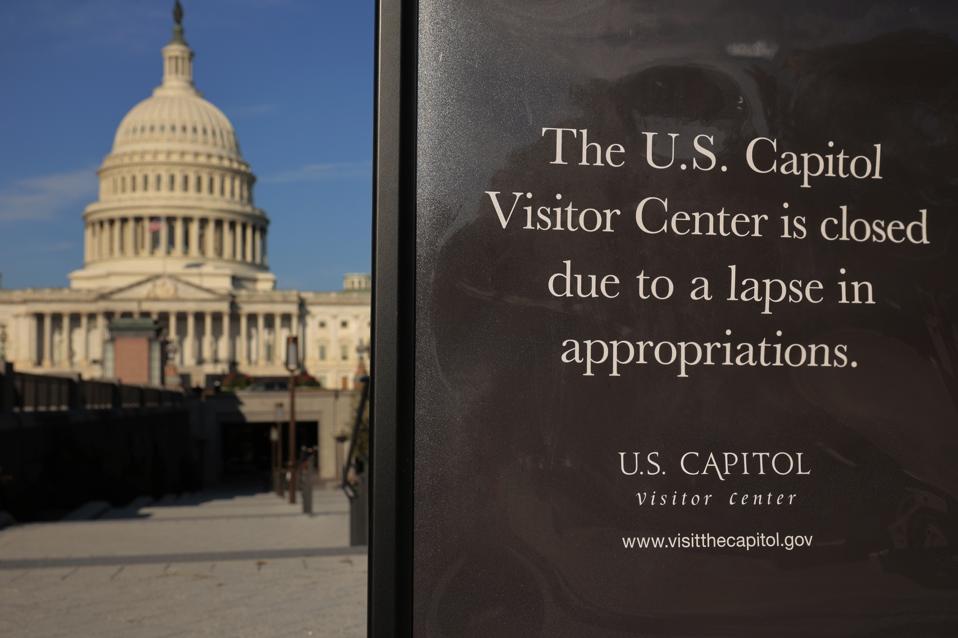

Nearly 80% of Americans – and more than half of Republicans – want Congress to extend tax credits for those with individual coverage under the Affordable Care Act also known as Obamacare, a new KFF poll shows. Whether to extend the tax credits has become a key issue that contributed to this week’s shutdown of the federal government. In this photo, the U.S. Capitol Visitors Center is closed to visitors during the federal government shut down on October 01, 2025 in Washington, DC. The government shut down early Wednesday after Congress failed to reach a funding deal. ( (Photo by Chip Somodevilla/Getty Images)

Getty Images

Nearly 80% of Americans – and more than half of Republicans – want Congress to extend tax credits for those with low and moderate incomes so they can afford individual coverage under the Affordable Care Act, a new KFF poll shows.

The tax credits, or subsidies, make health insurance premiums more affordable for individuals and were enhanced by the Biden administration and the Democratic-controlled Congress in 2021, allowing more Americans to buy coverage. The enhanced subsidies, which expire at the end of this year, helped enrollment in the ACA’s individual coverage, also known as Obamacare, eclipse a record 24 million Americans and help its popularity hit all-time highs.

But legislation sitting before Congress that would extend the tax credits has yet to pass either the U.S. House of Representatives or the U.S. Senate. The issue of whether to extend tax credits is the key issue that led to this week’s shutdown of the federal government after President Donald Trump and his fellow Republicans in Congress didn’t come to an agreement with Democrats about the future of the enhanced subsidies.

“More than three-quarters (78%) of the public say they want Congress to extend the enhanced tax credits available to people with low and moderate incomes to make the health coverage purchased through the Affordable Care Act’s marketplace more affordable,” KFF said in its analysis of the poll data, which was released Friday. “That’s more than three times the share (22%) who say they want Congress to let the tax credits expire.”

What’s more, KFF’s analysis said “most Republicans (59%) and ‘Make American Great Again’ supporters (57%) favor extending the enhanced tax credits, which otherwise would expire at the end of the year and require Marketplace customers to pay much more in premiums to retain coverage.”

“Larger majorities of Democrats (92%) and independents (82%) also support extending the enhanced tax credits, as do most people who buy their own health insurance, most of whom purchase through the marketplace (84%),” the KFF analysis of the poll data said.

If Congress doesn’t extend the tax credits, Americans who buy coverage via the government’s healthcare.gov exchange or other state exchanges will see a major spike in premiums id 75% or more, health insurers have said. Open enrollment is scheduled to begin November 1 and run to Dec. 15.

An analysis earlier this month from KFF says enrollees in “benchmark” plans sold on the ACA’s exchanges who currently have the enhanced tax credits get significant reductions on their premiums.

Take, for example, enrollees “earning over 400% of poverty ($106,600 for a family of three in 2026),” KFF cited in an example in its analysis. These families “will not spend more than 8.5% of their incomes on out-of-pocket premiums for benchmark plans.”

“Without the enhanced tax credits, these same enrollees will experience a ‘double whammy’ in cost increases, not only losing all financial assistance available through the premium tax credits but also needing to cover the premium increases Marketplace insurers are planning for next year,” KFF wrote in its analysis.

If Congress doesn’t extend the tax credits, Republicans and Trump will be blamed, according to KFF’s poll.

“More people say they would blame President Trump or Republicans in Congress than

Democrats if tax credits are not extended,” the poll’s analysis shows. “About four in ten (39%) adults who want to see the tax credits extended say that if Congress does not extend these enhanced tax credits, President Trump deserves most of the blame, while another four in ten (37%) say the same about Republicans in Congress. About two in ten (22%) say that Democrats in Congress deserve most of the blame, driven heavily by Republicans.”