NVIDIA just hit $4 trillion in market cap. With the advent of agentic AI and physical AI, the real … More

NVIDIA became the first company ever to reach $4 trillion in market value today, a milestone that took just over two years from $1 trillion. This unprecedented rise has been driven by insatiable demand for AI infrastructure and its new Blackwell graphics processing units (GPUs) architecture. But the real story isn’t the valuation.

This is just another signal that three massive economic shifts are accelerating, creating both existential threats and extraordinary opportunities for businesses across every industry. Let’s put NVIDIA in perspective.

Where NVIDIA Dominates

The company generated $130.5 billion in fiscal 2025 revenue, up 114% year-over-year. Their data center segment alone reached $115.2 billion, growing 142%. This isn’t a chip company anymore; it’s the primary infrastructure provider for the AI revolution.

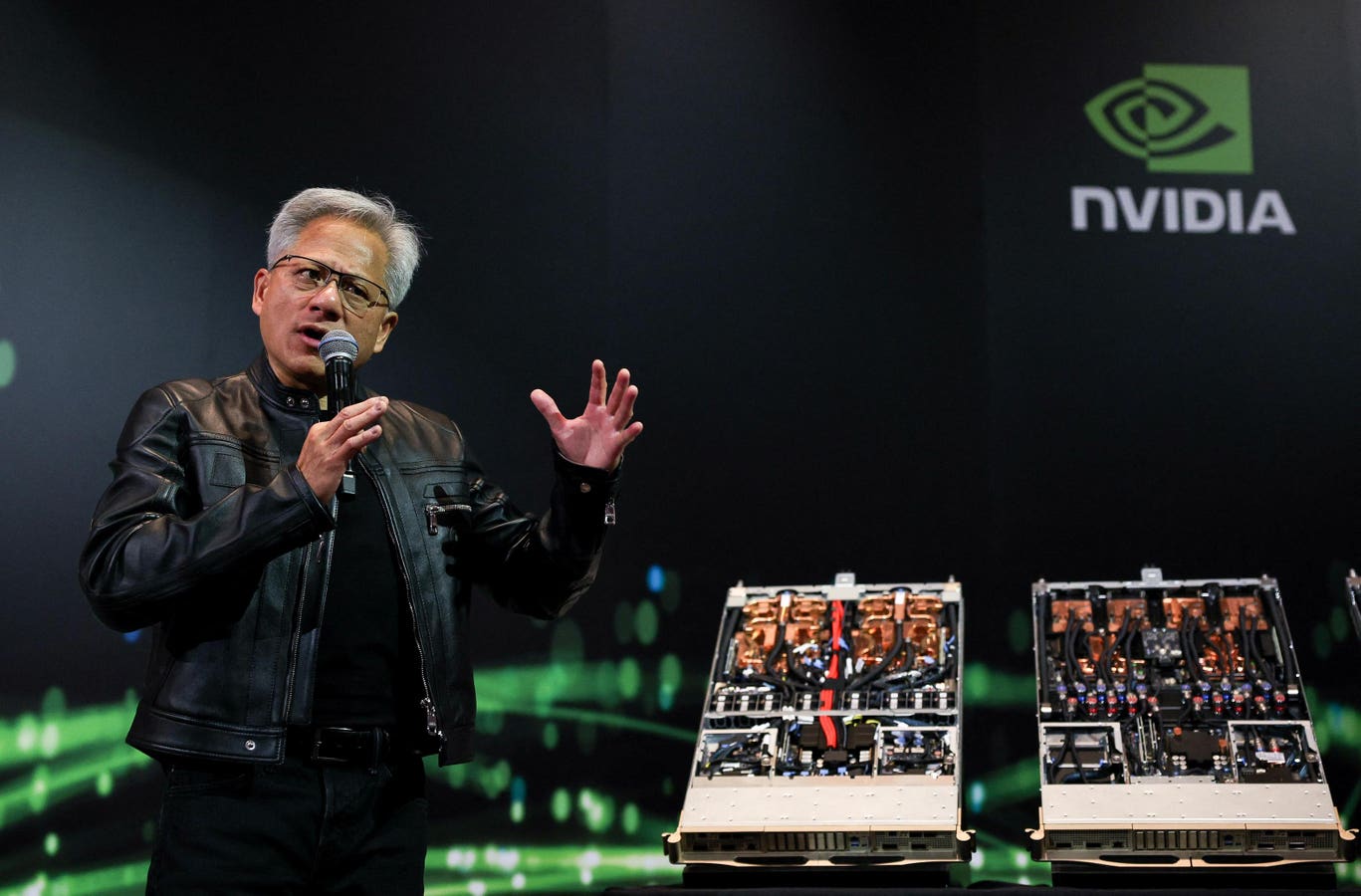

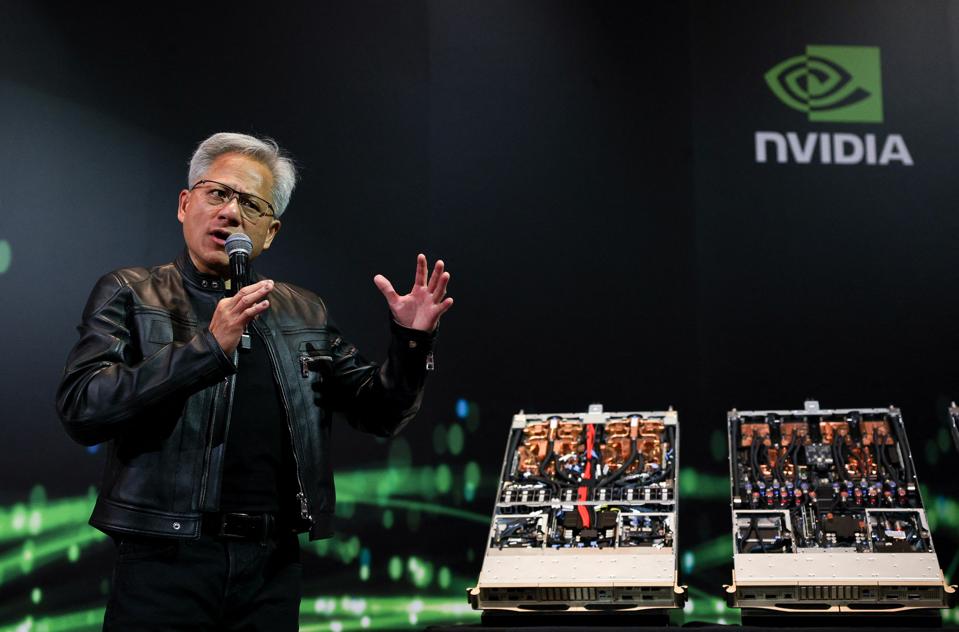

NVIDIA has transformed from a chip manufacturer to an AI infrastructure company

The company’s dominance in AI computing (holding 92% of the data center GPU market) has positioned it at the epicenter of the multi-trillion dollar infrastructure buildout that will reshape the global economy through 2030. This achievement represents more than financial success; it signals the transformation of computing from a support function to the primary engine of economic value creation, with NVIDIA’s AI factories producing the computational power that drives everything from ChatGPT to autonomous vehicles.

NVIDIA dominates the market for datacenter GPUs.

The journey from $1 trillion to $4 trillion took just over two years, a velocity that reflects both the explosive growth of AI adoption and NVIDIA’s strategic positioning. At the heart of it all is CUDA.

The CUDA fortress defines modern AI development

NVIDIA’s true competitive moat lies not in silicon but in software. In 2006, NVIDIA introduced CUDA (Compute Unified Device Architecture) as a proprietary parallel computing platform and application programming interface (API). CUDA lets software tap into graphics cards to speed up computing tasks beyond just graphics. Think of it like this: Graphics cards are really good at doing lots of calculations at once. CUDA figured out how to use that horsepower for regular computing work, not just making video games look pretty.

Since its launch, the CUDA ecosystem has created an impenetrable fortress of developer lock-in that competitors have failed to breach despite years of effort. Today, the success of the CUDA model has led to the creation of a thriving ecosystem that creates network effects that strengthen with each passing year. The ecosystem now includes over 5 million CUDA developers, 40,000 companies, and thousands of generative AI companies that are all building on the NVIDIA platform.

This software dominance translates directly to pricing power. NVIDIA maintains 78% gross margins offering software-like returns on hardware sales, while competitors like AMD and Intel have gross margins at 47% and 41% respectively. The company’s ability to charge $30,000+ per high-end GPU reflects not just scarcity but the irreplaceable value of the CUDA ecosystem in accelerating AI development timelines.

AI is powering the new Industrial revolution with Agentic AI and Physical AI as the next waves.

1) The AI Infrastructure Wave

While everyone debates whether AI is overhyped, companies are committing $6.7 trillion to AI infrastructure by 2030, according to McKinsey. To put that in perspective, that’s about 23% of the $30 trillion U.S. GDP.

Microsoft is spending $80 billion on AI infrastructure this year alone. Google allocated $75 billion. Amazon topped $100 billion. These aren’t R&D experiments. Big tech is building the foundation for an entirely new AI-driven economy. Access to AI capabilities will soon determine competitive advantage as much as access to electricity did in the 1920s. The companies securing priority access to these tools today will have insurmountable advantages over those waiting for prices to come down. With so much demand, NVIDIA customers currently face up to 4–8 month lead times for their advanced AI chips.

2) The Agentic AI Wave

Forget chatbots and content generators. The real transformation is autonomous AI systems that work like digital employees, handling entire workflows from start to finish.

Here’s the difference: ChatGPT responds to prompts. An AI agent identifies problems, researches solutions, executes multi-step plans, and adapts its approach based on results, all while you focus on other priorities. It’s the difference between a helpful assistant and a capable colleague.

The agentic AI market is set to explode. Market.us projects it will grow from $5.2 billion in 2024 to $196.6 billion by 2034 – a nearly 40-fold increase in just one decade. Salesforce CEO Marc Benioff even went as far to say at this year’s Davos conference that today’s executives will be the last generation to manage entirely human workforces. AI agents aren’t coming to the workplace, they’re already here, quietly handling an expanding range of business tasks.

Companies are already deploying AI agents that handle customer service, manage inventory, process insurance claims, and conduct market research. Early adopters report significant productivity gains and millions in cost savings.

So where can one start? Identify your most repetitive, rule-based processes. These are prime candidates for AI automation within the next 18 months.

3) The Physical AI Wave

While everyone focuses on software, the biggest opportunity may be in physical AI – embodied intelligence that thinks and acts, where robots and automated systems understand and manipulate the real world.

NVIDIA CEO Jensen Huang made the bold prediction at the COMPUTEX tech conference in Taiwan that “all factories will be robotic.” The factories will orchestrate robots, and those robots will be building products that are robotic. This isn’t science fiction. He’s describing the multi-trillion industrial transformation already underway.

Figure’s humanoid robot achieves 400% speed boost at BMW plant

According to Grandview Research, the global AI in robotics market was valued at approximately $12.77 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 38.5%, reaching around $124.77 billion by 2030. Tesla’s factory already uses autonomous robots. BMW has deployed thousands of AI-powered robots globally. Even Amazon’s warehouses run on AI-directed automation.

Manufacturing costs are about to plummet for companies that adopt AI-powered automation, while traditional manufacturers get left behind. But the opportunity extends far beyond factories. This will extend to retail, logistics, agriculture, construction, and every aspect of industry will be transformed.

Maybe now is a good time to audit your physical operations. Where do you still rely on manual processes that robots could handle more efficiently and reliably?

It’s Still Early…But These Waves Are Coming

The infrastructure buildout creates a narrow window for businesses to establish their AI foundation. I estimate that companies have roughly 18-24 months before competitive advantages solidify around access to AI capabilities. Once AI adoption reaches critical mass in your industry, the advantages compound. Early movers get better data, more experience, and superior customer relationships. Late adopters face the impossible task of catching up while the leaders accelerate further. Build AI capabilities that can work across different platforms rather than locking into any single provider’s technology.

So What Should We Do Now?

In the Short-Term (Next 3 Months):

- AI Capability Audit: Map your current AI tools against your business processes. Identify gaps between what you need and what you have.

- Competitive Intelligence: Research how AI is being deployed in your industry. What are your best competitors doing that you’re not?

- Process Documentation: Catalog your repetitive, rule-based work. These processes are prime targets for AI automation.

In the Medium Term (Next 12 Months):

- Pilot Projects: Start small-scale AI experiments in low-risk areas. Learn what works before making major investments.

- Partnership Strategy: Establish relationships with AI vendors, system integrators, and technology partners. The best capabilities are increasingly reserved for priority customers.

- Talent Development: Begin training your team on AI tools relevant to your industry. The learning curve is steeper than most leaders expect.

In the Long-term (Next 2-3 Years):

- Build vs. Buy Strategy: Determine which AI capabilities you need to own versus those you can outsource.

- Data Infrastructure: Invest in systems that capture and organize your business data. AI is only as good as the information it learns from.

- Business Model Innovation: Consider how AI enables entirely new ways to serve customers or operate your business.

The $20 Trillion Opportunity

IDC projects AI will drive a $20 trillion economic transformation by 2030. Said another way, every dollar spent on AI will generate $4.60 into the global economy.

The question for every business leader is simple: Will your company participate as a beneficiary or become a casualty of someone else’s AI-driven disruption?

NVIDIA’s $4 trillion milestone isn’t the peak – it’s the beginning of the next wave. The real AI boom hasn’t started yet because most businesses are still treating AI as a tool rather than a transformation. The companies that recognize AI as a new way of operating, not just a new technology to implement, will define the next decade of business success.