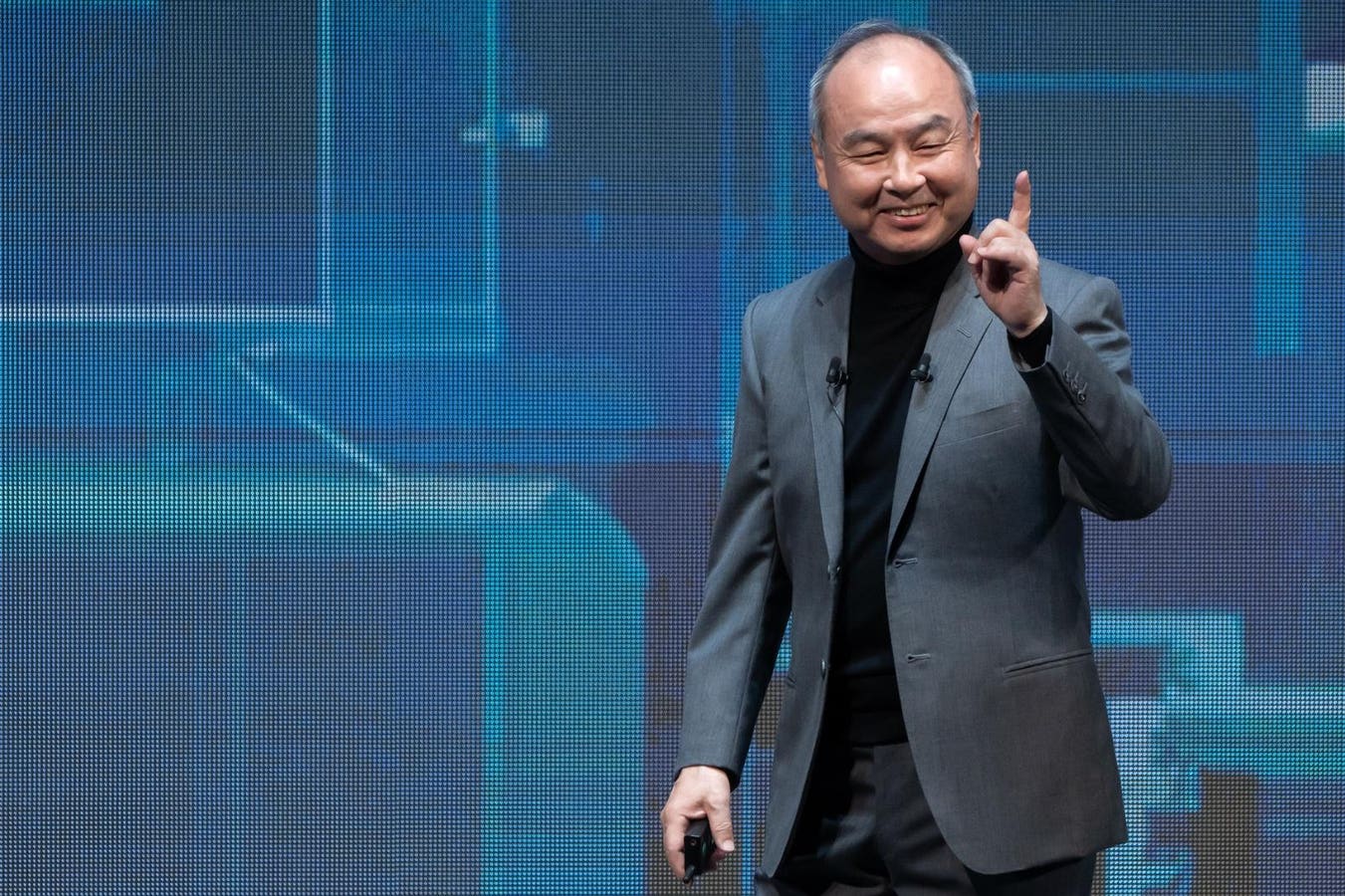

SoftBank Group CEO Masayoshi Son speaks at the SoftBank World 2023 in October 2023 in Tokyo.

Photo by Tomohiro Ohsumi/Getty Images

SoftBank agreed to acquire $2 billion worth of stock in beleaguered chipmaker Intel as the Japanese conglomerate continues to deepen its investment in the U.S., according to a joint statement by the two companies published Tuesday.

The deal, subject to customary closing conditions, will see SoftBank acquire Intel common stock at $23 apiece, according to the statement. That price is slightly lower than the Nasdaq-listed chipmaker’s closing price of $23.70 per share on Monday. Following the announcement, shares surged 5.3% in after-hours trading.

“Masa [SoftBank founder Masayoshi Son] and I have worked closely together for decades, and I appreciate the confidence he has placed in Intel with this investment,” Intel CEO Lip-Bu Tan said in the statement.

Just two weeks ago, Tan was asked by U.S. President Donald Trump to “immediately” resign amid concerns over his earlier ties to China. The Trump Administration was later widely reported to be in talks with Intel, as the White House negotiates for the American government to take a stake in the company.

SoftBank, on its part, is scouting for investment opportunities linked to semiconductors and artificial intelligence as Son has been increasingly focused on AI.

It has invested in ChatGPT creator OpenAI and is working with the latter on the $500 billion Stargate AI infrastructure project in the U.S., becoming an investor darling. Its Tokyo-listed shares have rallied almost 80% this year, making Son the richest person in Japan following a four-year gap.

The 68-year-old mogul, now with a net worth of $56 billion largely based on a SoftBank stake, is seen as having a winning investment strategy. Investors are back to “thinking Mr. Son is an investing genius,” Deutsche Bank analyst Peter Milliken wrote in a research note published last Friday.

Investors have long applied a discount to SoftBank shares due to concerns over what was perceived as Son’s aggressive and risky investment style. Milliken thinks such discounts are no longer viable, and he has set a price target of 20,000 yen ($135.3) per SoftBank share, suggesting an upside of 21.5% from Tuesday’s price.