In 2019 Synchron was two years into a $10 million series A when they announced their first human implant, which included a statement by founder and CEO Thomas Oxley:

“This industry is going to unlock the brain’s computational power in ways that are hard to imagine now. This is just the beginning.”

Last week the company announced a $200 Series D to advance their pivotal clinical trial and expand to San Diego, where they are developing their next-generation brain-computer interface system.

I spoke with Oxley to learn more about what’s next for Synchron and discuss BCI past, present, and future.

Memory Lane

Before looking forward, let’s catch up from 2019 to the present:

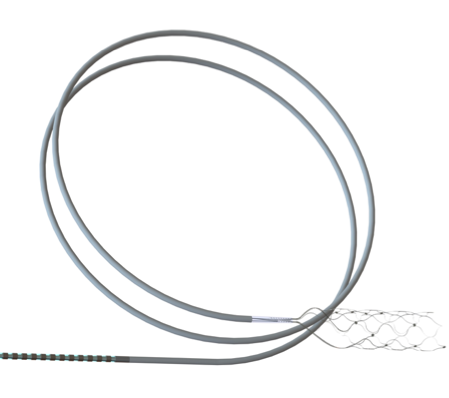

In 2020 the FDA granted Synchron Breakthrough Designation for their Stentrode. Khosla Ventures led their $40m Series B in 2021, a year Oxley ended by hosting the world’s first social media posted from a BCI user named Philip on his Twitter.

In 2022 Synchron helped establish BCI as more than a science project by beginning an early feasibility study and raising a $75 million Series C from Bill Gates, Jeff Bezos, and ARCH Venture Partners, among others.

In the last two years, they’ve published safety results, grown their executive team, and struck deals in manufacturing, built applications with Apple, Amazon, OpenAI, and NVIDIA, while building a playbook for the field to follow, remix or otherwise react to.

Deal Notes

This round brings Synchron’s total funding to $345 million to date and a reported valuation of “about a billion dollars.”

New investors include Double Point Ventures, the Australian National Reconstruction Fund (NRF), T.Rx Capital, Qatar Investment Authority (QIA), K5 Global, Protocol Labs, and IQT.

“I feel very lucky to have a range of investors who are taking a long term view on where this is going and supporting the journey,” Oxley said. He described the series lead Double Point as a TechBio investor with digital health experience, and spoke of board maturation with the addition of Campbell Murray’s 14 IPO track record.

The deal included the Australian sovereign fund, a prodigal return for Oxley, the Qatar Investment Authority, as well as a leading crypto BCI investor in Protocol Labs.

“All of our insiders came back in,” noted Oxley, speaking of ARCH, Khosla, Bezos, NTI, Metis, and others. “That’s often not the case…it’s a massive fundraise for them, and a huge amount of work. When their answer is yes, it just makes a big difference.”

Team Sport

When I asked about their new San Diego office, Oxley described a new division to create their next-gen system. This effort will be spearheaded by industry veterans Andy Rasdal, already a board member, and Mark Brister. Beyond attracting local talent from the likes of Dexcom and QualComm, Synchron will set up a vertically integrated manufacturing operation in Southern California.

“New York’s got great talent for machine learning,” he said of Synchron’s expanding AI operation. “You’ve got Apple here, you’ve got Google here. But medtech in New York is hard.”

Their first generation system was contract manufactured out of Minneapolis, a process led by CTO Riki Banerjee, who left the company this summer. She recently spoke about her four years at Synchron as employee number five, where she built supply chain, quality systems, and more.

“Ricky was wearing multiple hats and setting up processes from scratch,” Oxley reflected. “She contributed to hiring, values, culture. Organizational development. Supply chain, vendor relationships. Contract negotiation. We wouldn’t be here without her.”

With Rasdall and Bristol leading their new R&D, Oxley is now focused on what’s next.

Next Gen

Oxley has said about 20 percent of Series D will go to to their next-generation system, which remains in stealth mode.

He loosely described a minimally invasive, trans catheter, high-channel count, whole-brain interface. He sold Rasdall and Brister on this vision, based on “a microelectronics breakthrough that means we can deliver a very large number of channels across multiple brain regions.”

This is an evolution of Synchron’s thesis as a company: “It comes back to this idea that to be successful in BCI, you have to cover three things. One is access at scale, or getting out of the operating room. Two is coverage of the brain without destroying the local architecture. And three is data, and using more data to generate better function.”

In effect Synchron is incubating a new startup. “This is what’s going to happen in BCI,” Oxley said. “It’s very unusual for a class three implantable company that can build iterative products generationally. But it’s kind of like the early days of computers, where Intel was building new products that outperformed the previous ones. Otherwise the field is going to outgrow itself very quickly.”

Market Trends

What stands out amidst the floor of industry activity and technical advances across neural implants and beyond? Oxley calls the BCI funding surge positive, but questions if AI-like valuations in BCI are sustainable or realistic. “Is this a trend that is continuing? If an AI bubble bursts, how’s that going to impact BCI?”

On the industry side Oxley described today’s BCI field as a first wave of motor control, followed by speech, and vision as an emerging field. He is intrigued by biohybrid interfaces from Science and emerging ultrasound applications across the board.

In discussing BCI foundation models and the emerging field of neuroAI, Oxley anticipated the growth of neural data in the coming years, from tens of thousands of patient hours to hundreds and then millions of patient hours of data. Multimodal data beyond the brain will also drive a more holistic understanding of cognition and human context. This will drive better functionality for end-users of existing BCI systems, while unlocking more advanced understanding across new regions of the brain that will ultimately shape the next generation of applications.

As far as consumerization of neurotech, Oxley was optimistic about Apple’s potential to enable attentional shifting and cognitive applications through Airpods. He was less convinced about the prospect of whole brain implants for healthy individuals.

“I think there’s still going to be third or fourth generation systems before we get to that,” he offered. If there is a likely consumer application for implanted BCI, he envisions it could possibly be to protect or restore general cognitive decline that happens with age: “I much prefer that vision of BCI in the world, than this superhuman, transhumanist narrative you hear about.”

What Now?

Amidst a historic funding year – by my count, this deal brings 2025’s total for implanted BCI past one billion dollars – Synchron’s Series D holds deeper signal in neurotech, as they are the closest BCI company to the regulatory finish line for a PMA.

Synchron’s endovascular Stentrode array

Synchron

The degree of investor confidence in Synchron’s commercial future bodes well for their competitors too, especially given some of their new backers from the public sector and cryptocurrency are more company agnostic, and willing to back multiple companies.

From inception, Synchron’s Stentrode device was designed for speed to market and scalability, rather than maximizing channel count with more electrodes. They have souped it up recently, with a longer battery life, better wireless function and integration for evolving applications.

However, as competitors in the motor neuroprosthesis market catch up with far more advanced arrays, it remains to be seen whether Synchron’s first mover advantage will become a first mover disadvantage.

By closing this deal, Oxley and Synchron are investing in their ground game to enter the commercial market successfully while building a long-term bet all over again.