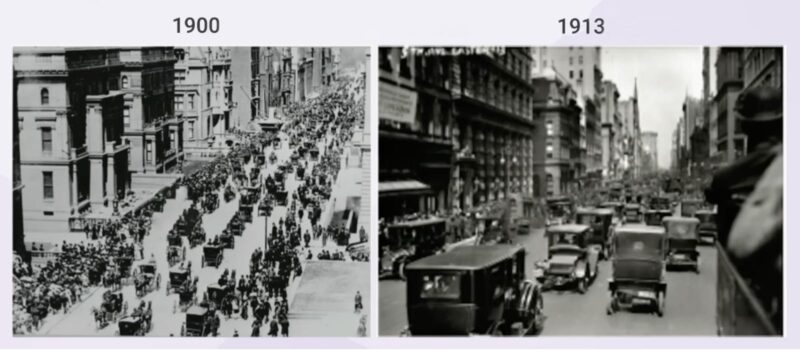

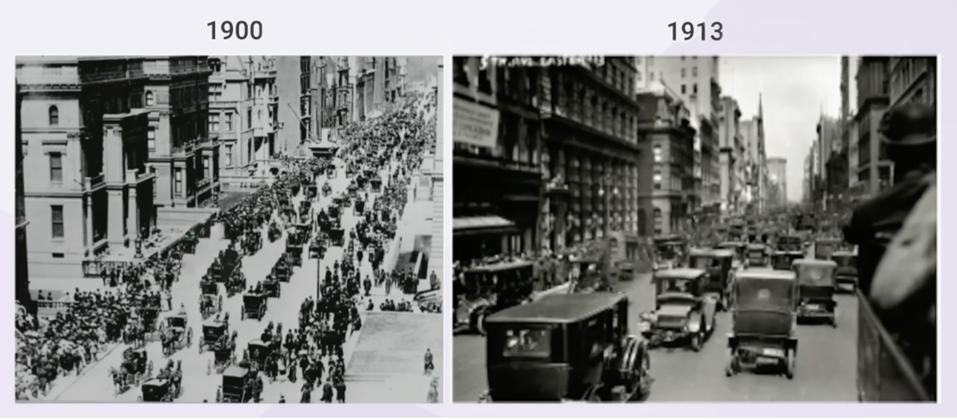

5th Avenue in New York City

New York Municipal Archives.

Today’s investors and executives may find strategies that built prosperity prove inadequate in the new era.

Since 2001, William Adamopoulos and his crack Forbes Asia team have run the annual Forbes Global CEO Conference, a premier gathering of the world’s business leaders. I’ve spoken and led panel discussions at each one and will again on Oct. 14-15 in Jakarta.

This year’s theme is “The World Pivots.” That’s putting it mildly. The ground beneath global business has shifted. What once seemed like stable paths are now riddled with fault lines. For CEOs and investors, the age of small refinements is history. As the world pivots, more than ever before, boldness, speed and vision will determine who thrives.

Shockwaves in geopolitics and technology now define the business and investment landscape. We live in a multipolar era where political and trade alliances form and reform with astonishing speed. Tariffs, once tools of taxation, have become strategic weapons. They redirect supply chains, reshape industries and determine which countries and companies rise or fall.

Asia’s CEOs know this firsthand. Export-oriented economies in the region face both opportunities and risks as trade flows are reordered. For decades, low costs drove supply chain strategy. Today resilience and national security weigh just as heavily.

If geopolitics is the tremor, technology is the earthquake.

Artificial intelligence, once the preserve of the world’s richest companies and largest data centers, has moved swiftly into every corner of daily life. Desktop, mobile, and soon, personal robots are bringing AI into homes and workplaces at scale. The phrase “AI for all” is not a slogan but a straight line to the future.

The implications are profound:

• A software developer in Jakarta or Bangkok can wield the same AI power once reserved for Silicon Valley giants.

• Productivity is no longer about marginal gains, but exponential leaps

• Barriers to entry are collapsing. A startup with a bold idea and hitched to AI’s evolutionary speed can now rival incumbents with decades of advantage.

The paradox for investors and executives is that the very strategies that built prosperity may prove inadequate in the new era. When the world pivots, stability is elusive. Entire industries may be compressed or reinvented in months, not years. Vinod Khosla, the Silicon Valley venture capitalist, likes to show the speed of change in two photographs of New York City’s 5th Avenue, one from 1900, the other from 1913. The first photo shows one car amidst dozens of horse-drawn carriages. The ratio is flipped in the later photo: one horse and dozens of cars.

In manufacturing, AI-driven robotics will redraw the labor cost map across Asia. For countries with falling populations, such as South Korea, robots will be salvation. In services, personalized AI will upend call centers, outsourcing, and even legal and professional advice.

History shows that in times of upheaval, cautious capital retreats while bold capital advances. Today is no different. The premium is on speed. He or she who acts in the fog of war, scales innovations quickly and nimbly surmounts (or tunnels under) barriers will usually win.

This does not mean recklessness. It means the willingness to commit when others hesitate. To launch when others study. To expand when others contract.

Asia’s businesses have done this before. Japan’s technology champions, South Korea’s chaebols, and China’s e-commerce giants all rose by seizing moments of disruption. The next wave of leaders in Asia will emerge the same way: not by waiting for certainty, but by creating it.