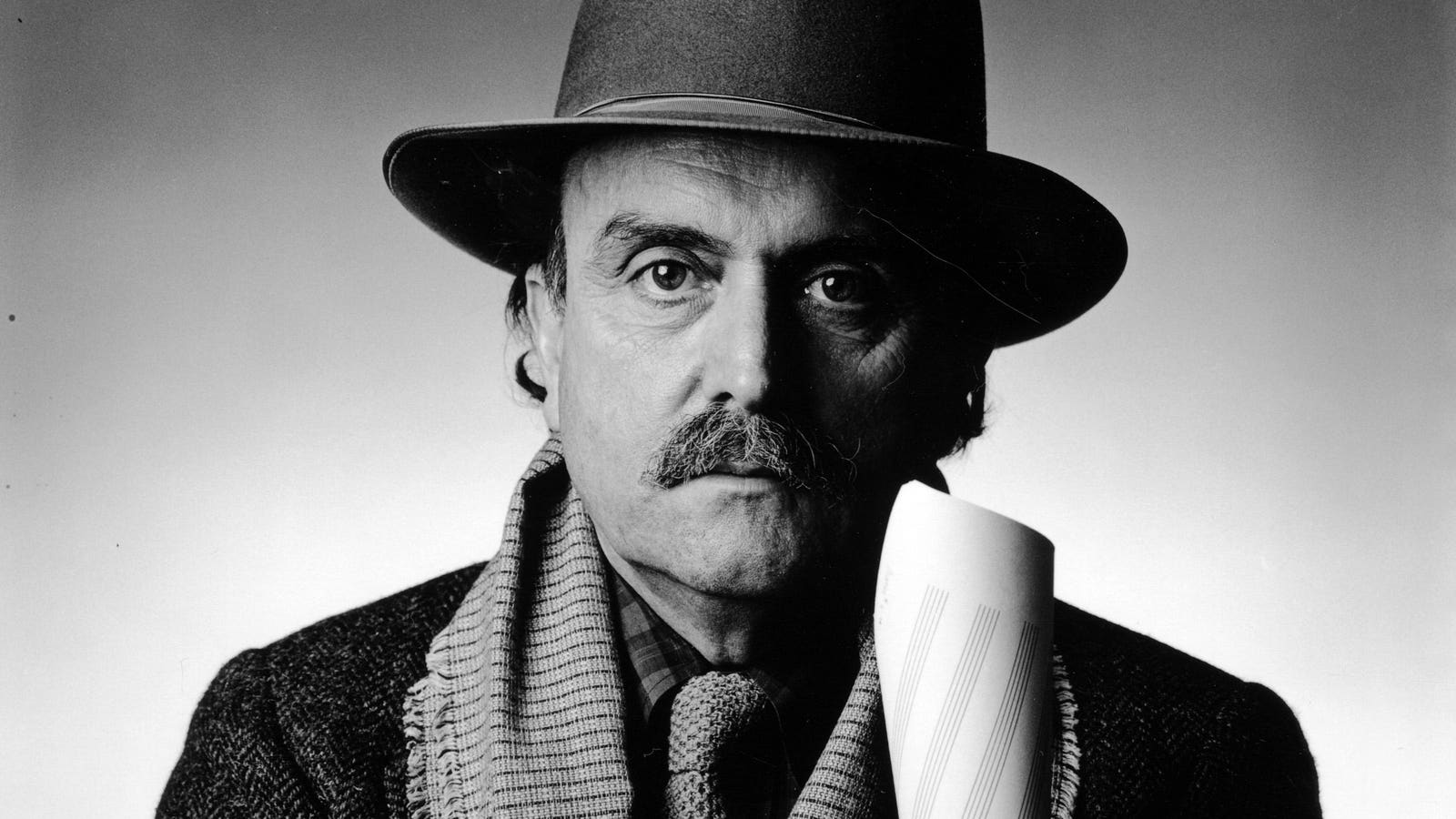

Vincentas Grinius is a tech entrepreneur and cofounder of IPXO, with a focus on internet infrastructure and sustainable digital innovation.

As cofounder of IPXO, an IP management platform, I’ve spent over a decade in internet infrastructure, watching IPv4 addresses evolve from basic networking tools into valuable financial assets. What began as a simple protocol in the 1980s has become a billion-dollar market, yet most enterprises remain unaware they’re potentially sitting on revenue streams worth hundreds of thousands of dollars.

With IPv4 addresses now trading at $20 to 30 each and IPv6 adoption progressing slowly, we’re in an unprecedented situation where legacy infrastructure has become a commodity. Here’s your practical roadmap for evaluating and potentially monetizing these hidden assets.

Audit Your IPv4 Holdings

Most organizations lack complete visibility into their IPv4 footprint, particularly those that have grown through acquisitions. Start by gathering documentation from your Regional Internet Registry (RIR), such as the American Registry for Internet Numbers (ARIN) in North America and Canada and the RIPE NCC in Europe.

Here are some key questions to ask:

• Which addresses actively route traffic versus sitting unused?

• Do we have proper legal documentation proving ownership?

• Are there transfer restrictions or encumbrances?

Documentation gaps are endemic. I’ve seen companies discover forgotten address blocks worth over $1.6 million during routine audits. If records are incomplete, work with your RIR to reconstruct allocation history—missing documentation can be rebuilt but requires time and administrative effort.

Geographic restrictions also complicate matters. Some RIRs limit transfers to specific regions, affecting your monetization options. Identify these constraints early to avoid surprises later.

Evaluate Monetization Strategies

Once you understand your holdings, assess whether leasing or selling aligns with your strategic goals. This decision requires input from finance, legal and operations teams.

Leasing Considerations: Leasing preserves ownership while generating recurring revenue of $0.30 to $0.60 per address monthly. This suits organizations maintaining a growing cloud infrastructure, as addresses can be reclaimed when needed.

Sale Considerations: Selling your IPv4 holdings provides immediate capital but sacrifices future flexibility. This path works for organizations migrating entirely to IPv6 or needing capital for other investments.

Risk Assessment Framework: Consider your five-year technology roadmap carefully. Companies I’ve worked with who sold addresses prematurely later faced expensive repurchasing decisions when IPv6 timelines slipped—a common occurrence given the technical complexity of full migration.

Navigate Legal And Financial Complexities

Treating IPv4 addresses as financial assets requires proper governance. This means involving legal counsel familiar with internet governance and ensuring compliance with both corporate policies and regulatory requirements.

Establish clear ownership documentation. Transfer agreements, RIR records and internal asset registers must align. Any discrepancies can delay transactions or create legal complications.

Keep in mind that IPv4 monetization creates taxable events. Whether structured as capital gains (for sales) or ordinary income (for leasing), consult tax professionals familiar with digital asset transactions.

Addresses previously used for spam or malicious activities lose value significantly. Implement reputation monitoring to understand your addresses’ standing before entering any transaction.

Choose Partners Strategically

The IPv4 marketplace involves technical, legal and financial complexities that most enterprises shouldn’t navigate alone. However, not all platforms offer equivalent services or protections.

Look for comprehensive due diligence, not just transaction facilitation. This includes reputation monitoring, abuse prevention and technical validation. Platforms handling only financial aspects leave enterprises exposed to reputation risks.

Then, assess the scope of provided services. Full-service platforms manage everything from technical configuration to legal documentation, reducing internal resource requirements but commanding higher fees. Limited-service brokers offer basic facilitation at lower costs but require more internal expertise.

Partner with organizations providing transparent market data. I’ve seen IPv4 pricing swing 30% in six-month periods, which makes real-time market intelligence crucial for optimizing timing and pricing decisions.

Moving Forward

IPv4 monetization represents a unique opportunity in enterprise asset management—digital resources that often appreciate while generating income. However, success demands serious treatment with proper analysis, legal oversight and strategic planning.

Organizations approaching this casually often leave money on the table or create unnecessary risks. The companies capitalizing today view digital infrastructure as a strategic asset class, not merely operational overhead. For enterprises discovering significant IPv4 holdings, the question isn’t whether to monetize—it’s how to do so strategically while maintaining operational flexibility for an uncertain technological future.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?