The little BYD Dolphin Surf city car could be the first electric vehicle to sell big numbers in Europe because of its price and qualities, rather than tax-payer funded inducements or government mandates.

And the advent of cheap but highly-capable little city cars might just rescue the European Union’s flawed attempt to force its citizens into electric cars they don’t want and can’t afford. So far, the majority of EVs haven’t excited private buyers or induced the start of a mass market because of high prices, poor charging networks and inhibited long-range autoroute performance. EU EV sales targets look challenging without the emergence of a mass market.

Nobody had to be induced to buy a modern mobile phone. But electric car sales in Europe have been forced on buyers to fulfill an EU mandate to gradually phase out internal combustion engines until only new EVs could be sold in 2035.

This is based on emissions of carbon dioxide, so the only realistic purchase in 2035 with zero CO2 emissions would almost certainly be electric.

Manufacturers must gradually increase the EV component of their sales. In 2025 the EU target is about 28%, it must hit about 80% by 2030 and reach 100% by 2035. Sales in 2025 must increase about 50% over last year’s to make the target. These targets have forced carmakers into all kinds of distortions as they induce unwilling buyers to go electric. For example, raising prices on highly popular and profitable ICE cars to induce the sale of a loss-making EV just to make the target.

EU regulations favor heavier EVs

EU regulations to allow heavier, more expensive EVs also skewed the market away from affordable, lighter sedans and SUVs. Not so in China, where manufacturers have developed a range of cheap and cheerful little EV runabouts which can be bought for as little as $7,000 before tax. These are now finding their way to Europe with uprated safety and regulatory changes, led by the Dacia Spring, Leapmotor TO3, and now the BYD Dolphin Surf, with prices starting at around €18,000 ($21,000) and averaging around €21,000 ($24,500).

Dacia is owned by Renault and the Spring is made in China. Stellantis has 21% stake in Leapmotor of China and the TO3 is made under license in Poland. China’s BYD is the world’s biggest maker of EVs and is expected to eventually produce the Surf in new factories in either Hungary or Turkey. Currently the vehicle is believed to be supplied from a factory in Thailand, which avoids EU tariffs.

Felipe Munoz, global automotive analyst at JATO Dynamics, said Europeans have been starved of small cars and vehicles like the Surf will appeal.

“Drivers in Europe still like small cars and the Surf features many things that appeal to them. It is true that it is not as cheap as expected, but it is more competitive than other electric city-cars from the traditional carmakers,” Munoz said.

“Still, €21,000 for a city-car is too much. And this is why I still believe that we are not there yet. Fiat, for instance, is about to release the (gasoline) version of the Grande Panda with prices starting at €15,000 ($17,500). When your budget is limited, €6,000 ($7,000) can make a huge difference,” he said.

A VW ID.2 concept version. The car will called the ID.Polo when launched in 2026. (Photo by Marcus Brandt/picture alliance via Getty Images)

dpa/picture alliance via Getty Images

According to Dr Michael Putz, managing partner at Automodicted consulting, there is a potential market for small EV city cars of about 30,000 a year in Europe worth about €750 million ($875 million).

“Despite the modest current addressable market, Chinese (manufacturers) are acting with long-term strategic intent. Should Europe stick to its decarbonization agenda, demand for small EVs could expand to about 2 million units worth about €50 billion ($58.4 billion) a year by 2035. For the Chinese, establishing brand presence now is a prerequisite to capturing this future growth,” Putz said.

(European auto manufacturers are currently seeking a dilution of the EU’s 2035 CO2 agenda, but it’s not currently clear how drastic this might be.)

Not opportunistic but existential

“This expansion is not opportunistic but existential. Intense competition in China has triggered a destructive price war, eroding profitability across the sector. Most Chinese (manufacturers) do not operate profitably in their domestic market at the moment. This explains the stark difference in prices between China and Europe,” Putz said.

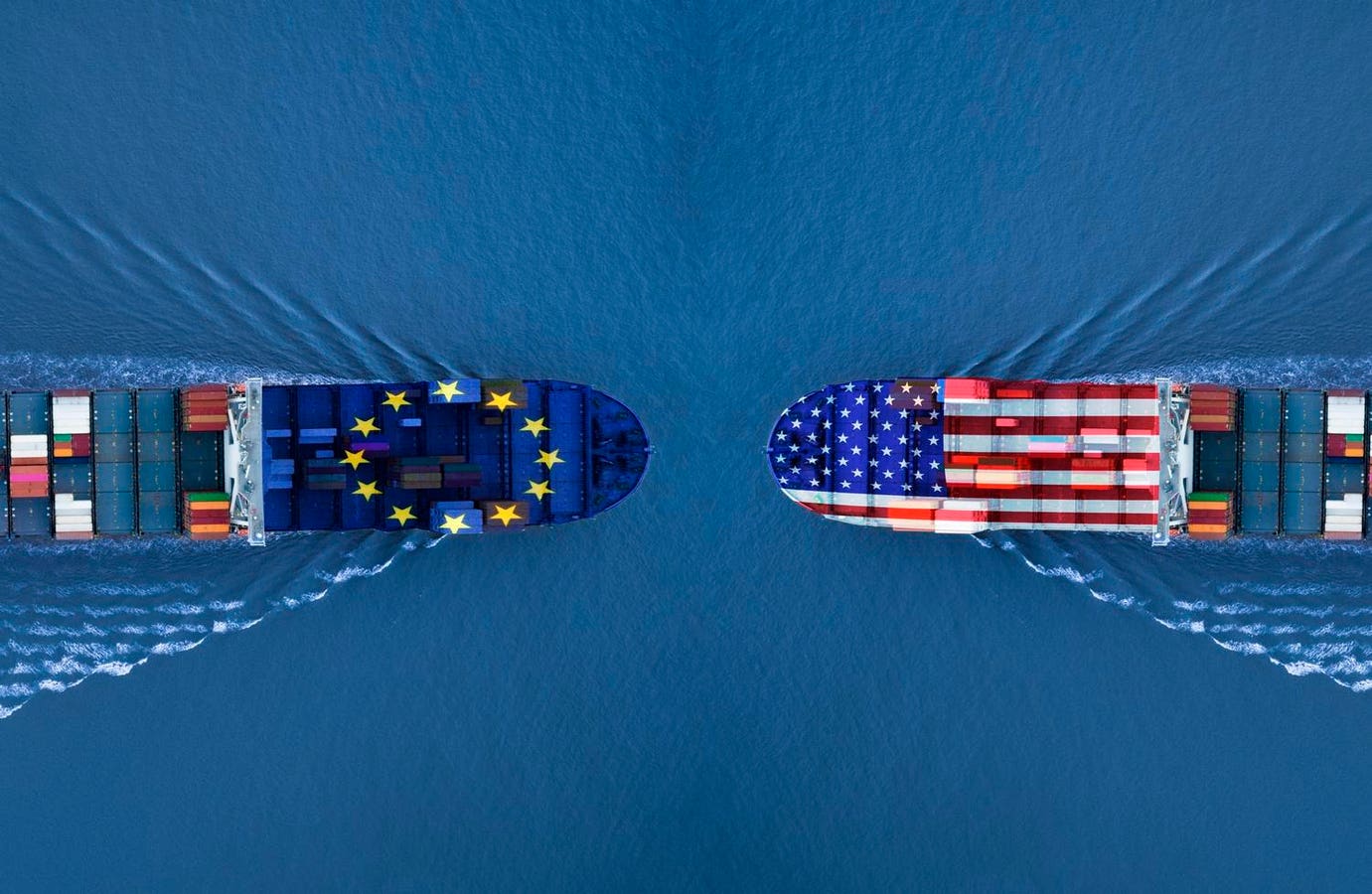

Chinese manufacturers need to sell more products abroad. With the U.S. blocked off by huge tariffs, Europe represents a big profit opportunity, according to Putz.

The European mass market challenge is still years away. Volkswagen will unveil its cheapest EV at the IAA Mobility 2025 next week in Munich. The ID.2, renamed the ID Polo, will sell for under €25,000 and won’t go on sale until next year. The even cheaper ID.1 isn’t expected until 2027, with prices starting at around €20,000.

But some European small EVs are hitting the market now, like the Citroen e-C3 and Fiat Grande E. And they have two big advantages, according to Putz.

“They benefit from two structural advantages: brand recognition and consumer trust, which often outweigh incremental price differentials,” he said.

Jamel Taganza, vice-president of French automotive consultancy Inovev, said competition from Volkswagen and Renault is getting ready, but the market has at least five years to meet the targets, if they remain unchanged.

Will Europeans ever be able to compete on price?

“I don’t think that European carmakers will be able to compete without support of EU tariffs, but moreover without rethinking their overall economic model,” Taganza said.

Chinese manufacturers won’t want another price war

“But also, it is not sure that Chinese companies will want to start a price war as it is the case in China. It may come from a disruptive Chinese company but right now companies like BYD are also interested in having interesting profits in Europe and adjust the price at the right level just under the competition but not with a massive gap,” he said.

Fiat Grande Panda battery electric car. (Photo by Sjoerd van der Wal/Getty Images)

Getty Images

According to Putz, the city car sector can’t make a crucial difference to the EU emissions regime.

“Most critically, small EV city cars alone cannot meaningfully advance Europe towards its 2030 emissions targets. The majority of potential CO₂ reduction lies in larger vehicle categories, particularly SUVs, where current emissions intensity is far greater,” he said.

BYD Dolphin Surf Comfort

Electric motor – 154 hp

Torque – 220 Nm

Gearbox – automatic

Battery – 43.2 kWh LFP blade

Claimed range – 288 miles WLTP

Drive – front wheels

Acceleration – 0-60 mph 8.9 seconds

Top speed – 95 mph

CO2 – zero while driving